Getting started with investing can be intimidating, overwhelming, and confusing. Imagine if you could pick just one investment and put all you money into that. Whenever you have more funds to invest, just buy more of that one thing. Now you can! Asset allocation ETFs appeared on the investment scene just a couple of years ago. Because they’re so new, many people are unfamiliar with them. Learn what they are, and consider if they’re right for your own investment needs. See which ones I’m recommending to my own young adult children.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

In the interest of full disclosure, I want to state right up front that in this article I discuss ETFs, some of which I own and/or family members own. I also want to make clear that I am not a registered investment advisor, and personal finance is just that – personal. Please make the best investment decisions that are right for your situation.

What is an ETF?

Let’s start at the beginning. ETF is short for “exchange traded fund”. I’m sure that clears everything up, right! Investopedia defines ETFs like this:

An exchange traded fund (ETF) is a type of security that involves a collection of securities—such as stocks—that often tracks an underlying index…

Investopedia

Investors can purchase shares in individual companies, such as Bank of Montreal, Imperial Oil, Barrick Gold, or Rogers Communication. You might get lucky investing in just a few companies. But it can also be very risky. Think if you were all in on Nortel , or Blockbuster, or Enron.

It’s much less risky to invest in a large number of companies. This is the “don’t put all your eggs in one basket” approach to investing.

ETFs are exactly this basket approach. Perhaps the best way to explain is with an example.

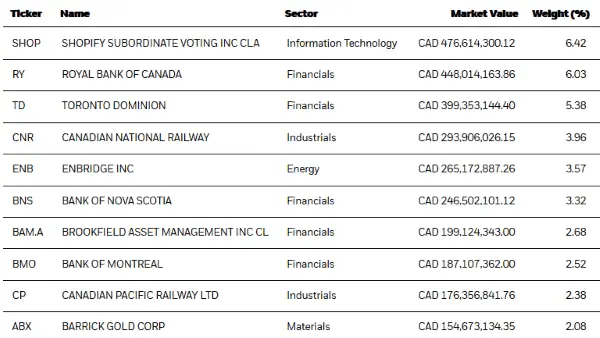

iShares XIC is an ETF from Blackrock that tracks the entire Canadian stock market, the TSX. It invests in over 200 companies, across a broad range of sectors.

This shows the top 10 holdings by value in iShares XIC. Even the largest, Shopify, is only 6.42% of the total fund. If Shopify suddenly dropped in value to $0 (highly unlikely!), the total value of the fund would go down a little. But your overall investment would still be okay. In fact, it might even be offset by other companies increasing in value at the same time.

By investing in ETFs that track market indexes, you generally lower your risk of one company having a bad year.

In addition, you can see that within the top 10, it covers a broad range of sectors. There’s information technology, financials, energy, industrials, and materials. It’s a little heavy on financials, but that’s a reflection of the Canadian economy. Even if one entire sector has a bad year, by investing in an ETF like this you’re well diversified.

How are ETFs different from Mutual Funds?

Mutual funds may also track stock market indexes, but not all of them do. Many mutual funds are actively managed, with a manager researching what to buy and sell. Because they are actively managed, the fees for investing in mutual funds are typically substantially higher than for investing in ETFs.

Another difference is that ETFs trade on the stock exchange and the prices fluctuate throughout the day just like any other stock. Mutual funds only trade once a day, after the market closes.

Staying with our iShares XIC example, the management expense ratio (MER) is 0.06%. That is, if you have $10,000 invested for a year, the fee deducted from the fund will be $6.

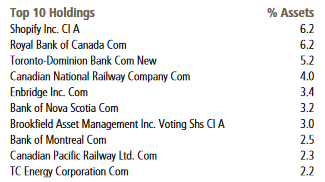

To compare, Scotiabank has a mutual fund called the Scotia Canadian Equity Index Fund. Here are its top 10 holdings. As we would expect, they are almost exactly the same as iShares XIC.

However, the management expense ratio (MER) for this fund is 1.00%. That is, for every $10,000 invested for a year, the fee deducted will be $100.

That’s not a typo! The for the ETF index fund is $6, and for the mutual index fund is $100 for the same 1-year $10,000 investment. For investing in essentially the same companies, in essentially similar amounts.

Types of ETFs

Exchange traded funds, like mutual funds, can invest in a wide range of underlying assets. The example we saw above was 100% stocks, tracking the Canadian stock market TSX index.

But they can also invest in a single industry, such as financial. A single country, such as the U.S. A single commodity, such as gold. Or they can invest in bonds, instead of stocks.

Bonds are essentially a loan from an investor, to a government or corporation. Bond investors receive an interest payment throughout the term of the bond, and get their loan back at the end of the term. Bond funds pool their investments over a large number of bonds. The benefits of a bond ETF is that it trades on the stock exchange, so you can buy or sell at your own convenience, rather than having to wait until the term of the bond ends to get your money back.

Why Invest in Bond ETFs?

Bonds tend to have lower volatility than stocks. You generally don’t get the high increases, but you also tend to not get the big crashes, either. Putting a portion of your investments into a bond fund can smooth out the ride. Here’s a comparison of iShares XIC – the Canadian index fund – with iShares XBB, the Core Canadian Universe Bond Index ETF.

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| iShares XIC total return (%) | 21.01 | 9.05 | -8.83 | 22.89 | 5.63 |

| iShares XBB total return (%) | 1.36 | 2.52 | 1.41 | 6.87 | 8.68 |

You can see in the previous 5 years, that investing in stocks only would have given you some pretty big swings – up almost 23%, down almost 9%. Investing in bonds only would have been a safer bet, ranging from a little over 1% up to over 8%.

Mixing the two – stock ETFs and bond ETFs – can often give you the best of both worlds. You generally get the higher growth of stocks, but the stabling influence of bonds.

Asset Allocation ETFs

You could invest separately into several different ETFs, to get stocks in a range of different countries and industries, as well as bonds. This requires tracking to see which ones go up a lot and which not as much, then selling some and buying others in order to rebalance your portfolio to keep it in line with your goals.

Some people like this hands-on process. Most other people would rather scrub toilets than rebalance their investment portfolio.

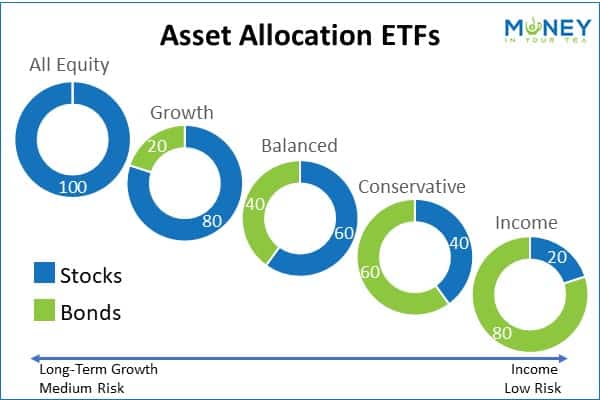

This is where asset allocation or all-in-one ETFs come in. Your only decision is what percentage you want to invest in bonds versus stocks.

They are generally defined as follows:

| Asset Allocation ETF Types | Equity (Stocks) | Bonds |

|---|---|---|

| All Equity | 100% | 0% |

| Growth | 80% | 20% |

| Balanced | 60% | 40% |

| Conservative | 40% | 60% |

| Income | 20% | 80% |

You might wonder why you would invest in this all-equity asset allocation fund, rather than a single ETF such as XIC. Good question. An all-equity asset allocation fund invests in several underlying ETFs in order to give you a mix of countries, even though it’s all equity.

For example, Blackrock’s all equity XEQT is comprised of approximately 47% U.S. stocks, 23% Canadian stocks, 23% combined from Europe, Asia and Australia, and the remainder from emerging markets around the world.

The other asset allocation ETFs include a similar mix of countries for equities, and add in bond ETFs.

How to Copy an Asset Allocation ETF on your own

Let’s say you have $10,000 to invest, and you wanted to mimic the iShares growth ETF, XGRO. You would need to purchase the following (as of Jan. 2021):

- $3,753 in iShares Core S&P Total U.S. STock (ITOT)

- $2,014 in iShares MSCI EAFE IMI index (XEF)

- $1,957 in iShares S&P/TSX Capped Composite (XIC)

- $1,156 iShares Core Canadian Universal Bond Index (XBB)

- $434 in iShares Core MSCI Emerging Markets (IEMG)

- $291 in iShares Canadian Dollar Corp Bond index (XSH)

- $187 in iShares US Treasury Bond ETF (GOVT)

Then once or twice a year you’d have to see which ones have grown more than the others, sell some shares and buy different ones, in order to rebalance to this same asset allocation. Otherwise you might have way more in U.S. stocks and not enough in bonds, for example. Phew! Who has time for all that, when you can get it all in one convenient ETF?

Which Asset Allocation ETF is Right for You?

My long-time readers will know that I always recommend investing based on your goals. If you need the money in 10 or more years, such as in your retirement fund, you can generally take more risk than money you need next year.

You can see how I approach this in my children’s education funds in RESP Investing from Newborn to High School. When they were young, I invested mainly in equities. As they grew older, I transitioned into bonds and GICs. And good thing I did, too. The 2020 stock market crash was just a few months before my son started university. Imagine if his education fund had dropped 20% at that time! Could I ask him to delay his program until the market recovered? Not likely.

Personal finance is personal, so you need to decide what mix of stocks and bonds is right for you, based on your when you will need this money, and how comfortable you are with risk. Will a market crash keep you up at night if you’re all in equity.

There are only a few companies selling asset allocation ETFs, which makes the choice easier for you.

| Asset Allocation ETF Types | iShares | Vanguard | BMO |

|---|---|---|---|

| All Equity (100% stocks) | XEQT | VEQT | – |

| Growth (80% stocks) | XGRO | VGRO | ZGRO |

| Balanced (60% stocks) | XBAL | VBAL | ZBAL |

| Conservative (40% stocks) | XCNS | VCNS | ZCON |

| Income (20% stocks) | XINC | VCIP | – |

How to Choose between iShares, Vanguard, and BMO?

On the surface there is little difference. They all invest in thousands of companies from around the world which gives excellent diversification. In my opinion, you can’t go wrong with any of these well-known companies.

If you’re highly motivated by fees – that is, paying as little as possible – the iShares asset allocation ETFs have a management expense ratio (MER) of 0.20%, while Vanguard’s is 0.25%. BMO also has a MER of 0.20%. On a $10,000 investment for 1 year, this means fees of $20 versus $25. You’ll notice that both are higher MERs than investing in XIC alone, but frankly this is a managed portfolio and you’re paying someone to do that work for you. It’s important to note that you don’t have to pay these fees directly out-of-pocket. They are simply deducted from the fund.

There is also a difference in the investment weights between countries. Looking at the 3 “growth” ETFs shows in addition to 20% in bonds:

- iShares XGRO – 20% Canadian equity, 38% U.S. equity, 24% international and emerging market equity

- Vanguard VGRO – 24% Canadian equity, 33% U.S. equity, 23% international and emerging market equity

- BMO ZGRO – 20% Canadian equity, 34% U.S. equity, 27% international and emerging market equity

(Note that it might not add quite to 80% equity due to rounding and slight variations in the actual investments from the target.)

New DIY investors should definitely NOT get hung up on the minor differences between the choices.

By far the biggest impact on your financial wealth will be how much you invest. Invest early and invest often. Set up automatic transfers to your investment account and log in regularly to purchase more of whichever asset allocation fund you choose.

Can you Invest in Asset Allocation ETFs in your RRSP, TFSA, or RESP?

Yes! You can absolutely invest in these funds within your registered accounts.

How to Invest in Asset Allocation ETFs

My favourite place for self-directed (or DIY) investing is Questrade. Questrade offers free ETF purchases, so it’s easy to see why they’re so popular. There are no account opening or closing fees. And no annual RRSP or TFSA account fees.

Once you open your account, simply choose the asset allocation ETF that’s right for you, and invest in just that one product. Every time you add more funds to that account, you just buy more. It couldn’t be easier. The ETF fund manager does all the rebalancing for you, keeping the fund within its target for each component.

Final Thoughts

With asset allocation ETFs, do-it-yourself investing has never been easier. Or cheaper. There’s no need to pay a high-priced investment advisor, or event a medium-cost robo-advisor. Investing is powerful, event with little money.

These all-in-one ETFs are particularly good for younger adults in their 20s or 30s, who are just starting to get into investing. Here’s why:

- You can get a highly diversified portfolio with relatively low investment amounts.

- You don’t need a lot of time or investment experience to get started.

- The fees are substantially lower than for mutual funds.

Pingback: Weekend Reading – Bernie memes, practice failure, cash reserves and more #moneystuff - My Own Advisor