With rental vacancy rates hovering near 1%, and high prices in the housing market, potential landlords may be considering a condo purchase. But where are the best Toronto neighbourhoods for condo investors? And how can you tell whether an apartment is a good deal or not? You can’t afford to lose money on your property, so discover the four key numbers you need to evaluate an investment.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

Real Estate as a Path to Financial Independence

I listen to a lot of personal finance podcasts. It’s a great way to increase your learning while you’re busy doing relatively mindless tasks – laundry, cooking, walking the dog.

One of my favourite podcast episodes was Jessica Moorhouse’s interview of Todd Tressider on her Mo’ Money Podcast. There’s a ton of great information on here. One of the gems is the three paths to wealth.

- The first best way to build wealth is to start your own business, and scale it. That is, have other people working for you where you can charge your customers more than you are paying your employees. This takes a lot of time and effort to build wealth.

- The second best way to build wealth is to buy real estate as investment properties. Real estate investing takes some time to evaluate and purchase the right property, and then periodic maintenance issues, but much less time than building a business. That’s what we’re diving into in this article.

- The final way to build wealth is to invest in financial products such as stocks, bonds, and so on. This takes the least amount of time and effort to set up, but it usually takes decades to reach your wealth objectives.

And these three paths are not independent of each other, either. You can choose to do two or all three if you wish.

If you want to listen to the podcast and go right to this section, it’s about minute 21 to 24. But it’s worth listening to the whole podcast.

You can find Todd online at Financial Mentor, and Jessica at her website Jessica Moorhouse.

How to Make Money in Condo Investing

There are essentially two ways to make money with real estate investing. The first is the monthly rental income that your tenant pays you, less all the expenses that you will have to pay, such as paying the mortgage, taxes, insurance, and property maintenance.

The second way to make money is to sell the investment for more than you purchased it for, including any costs associated with buying and selling the property. This is obviously a long-term strategy, since you will likely own the real estate for many years. It’s also more speculative, since it’s impossible to tell whether real estate prices will rise and by how much.

My own Experience with Real Estate Investing

Mr. Tea and I bought our current house about 15 years ago, and at the time it was divided into four apartments. There were two basement apartments, one on the main floor, and one upstairs.

We combined the main floor and upstairs apartment for our family’s living space. And we continue still to this day, to rent out the two basement apartments.

They both had existing tenants when we bought the house, and one of those tenants is still living in his apartment. It’s great to have a long-term stable tenant, but on the other hand the rent is subject to rent control. Rent increase guidelines are set by the Province of Ontario.

The other apartment is smaller, and tends to turn over about every two years. When an apartment is vacant, owners can set the next lease rate to whatever the market will bear. Now our smaller apartment is generating more rental income than the larger one each month.

In addition to the two apartments in our house, at various times we have looked at buying an investment property. We have not been able to find the right property for our needs that meet our financial requirements.

How to Evaluate an Investment Property

There are 4 key methods potential investors should use to determine if a property makes financial sense for them to purchase.

For the sake of clarity, let’s use an example as we go through these rules:

- Purchase price, including all costs $200,000

- Downpayment $40,000 (20% of the purchase price, which is standard for investment property)

- Rent $2,000 per month

- Monthly expenses (property tax, insurance, average maintenance costs) $600

- Mortgage principal and interest $1,000 per month

1% Rule

The one percent rule states that the monthly rent should be 1% or more of the total purchase price of the investment property. The purchase price should include any costs of the sale, such as legal fees, land transfer tax, repairs needed before renting, etc.

For example, a property selling for $200,000 would need a monthly rent of at least $2,000.

$2,000 ÷ $200,000 = 1%

Having a rent to purchase price of at least 1% will generally put an investor in a position of being able to cover all the expenses with the rental income. It is also, perhaps, the easiest to calculate since it only requires two numbers, one of which you know before you buy the property.

Positive Cash Flow

At a minimum, you want to be able to cover the mortgage payment and any other expenses related to the investment property out of the monthly rent.

It is calculated as rental income, less expenses and mortgage.

$2,000 – $600 – $1,000 = $400

In our example, after all expected monthly expenses and the mortgage payment, we anticipate generating $400 in positive cash flow each month.

Be sure to keep extra cash available to cover unexpected expenses such as a larger repair, or to cover costs in case of vacancy.

Capitalization (Cap) Rate

The cap rate is calculated as net operating income divided by total cost. Net operating income is the annual rent you receive, less all your costs, but not including the mortgage principal and interest.

Your costs will include things like estimated annual maintenance and repairs, taxes, insurance, a property manager if you use one, and more.

If your monthly rent is $2,000 and monthly expenses total $600, on an investment worth $200,000, then the cap rate is 8%.

($2,000 – $600) × 12 ÷ $200,000 = 8%

Rob Berger of DoughRoller suggests that investors should look for a cap rate of 6% or higher.

Cash on Cash Return

The cash on cash return is calculated as the annual rental income, less all expenses including the mortgage principal and interest, divided by the downpayment.

Typically real estate investors in Canada need 20% downpayment, which in our example would be $40,000.

The cash on cash return for our example would then be 12%.

($2,000 – $600 -$1,000) × 12 ÷ $40,000 = 12%

Investors should look for a cash on cash return of about 8-12%, says Paul Esajian at Fortune Builders.

What are the Best Toronto Neighbourhoods for Condo Investors?

Zoocasa has a fabulous article that just came out called, “Saving for a Condo Down Payment in Toronto? Here’s How Long It Would Take If You Didn’t Need to Pay Rent“. It’s worth clicking over to read it, for the awesome picture of Toronto’s historic flatiron building if nothing else.

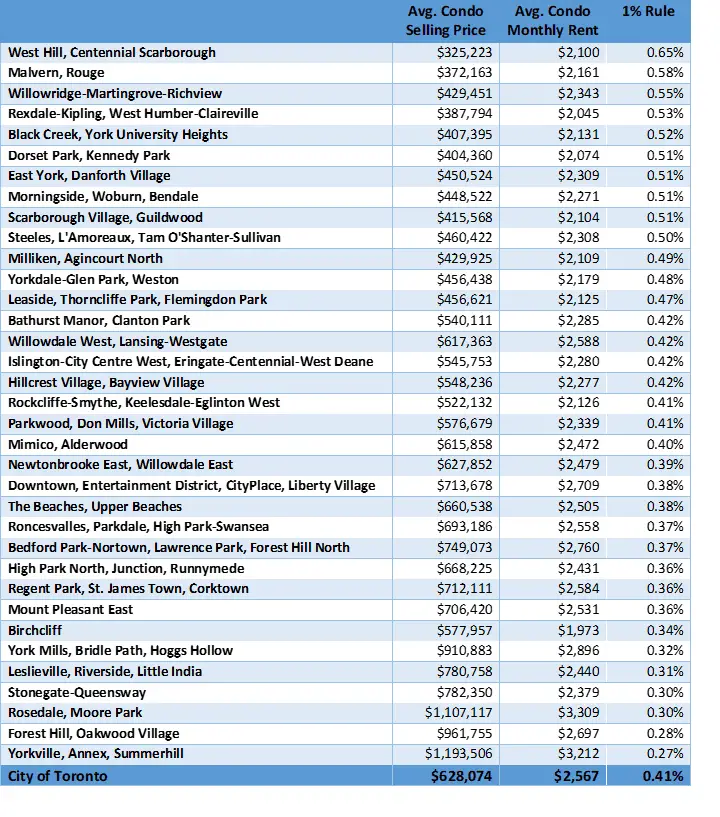

Zoocasa compares the average condo apartment lease rate per month, with the minimum downpayment required for a condo, across 35 Toronto neighbourhoods.

Using the same estimates for condo price and average rents, we can see which neighbourhoods, if any, come close to the 1% rule for real estate investing.

The 1% Rule for Toronto Neighbourhoods

Looking at these Toronto neighbourhoods, none have an average rent to purchase price of anywhere close to 1%. The highest is West Hill, Centennial Scarborough, with an average condo monthly rent of $2,100 and average condo selling price of $325,223. This gives a rent to purchase of 0.65%. To reach 1%, a landlord would have to charge $3,252 per month – substantially higher than the average rent for that neighbourhood. This also assumes no additional costs to purchase the condo, which isn’t realistic.

Notice that the neighbourhoods with the highest average rent to purchase ratio are all located at the outskirts of Toronto. The Downtown area, including the Entertainment District, CityPlace and Liberty Village has an average ratio of only 0.38%.

On the other hand, simply because an investment does not meet the 1% rule, it might still meet your needs. If you are still cash flow positive, you may get great capital gains. This is a bit more speculative than investing for income.

You may also find a property where you can be an owner-occupied investment. You could buy a two-bedroom condo, and rent out the second bedroom. The rent you charge would likely be more than half of the costs of the condo. It may be cheaper than renting yourself, and you are building equity in your investment property. In addition, you could be eligible to pay as little as 5% downpayment instead of 20% for an investment property.

What Else Influences Condo Investment Profitability?

At first glance, it does not appear that any Toronto neighbourhoods would be a good place to look as a real estate investor.

However, investors may still be able to find great deals within these neighbourhoods. While the average condo might sell for about $450,000 in Danforth Village, of course there is a wide range of selling prices. Price of any individual condo unit depends on apartment size, features and amenities, proximity to transit, and other neighbourhood and building characteristics.

The average Beaches rent may be about $2,500 per month. But this includes renters who have been living in their apartments for many years and their rents increase only by allowable rent control limits. If you are starting with a vacant apartment, you can charge whatever the market will bear.

If a potential investor can combine these two features – paying less than the average price, and charging rent higher than the average price, then you can increase the rent to purchase price metric closer to 1%.

Monthly costs will also vary widely, including taxes, expected maintenance, insurance, and so on. Mortgage costs depend on the interest rate and the length of the mortgage. Changes in each of these numbers will impact investors’ cash flow, cash on cash return, and cap rate.

Note that you can increase your cash flow by paying a larger downpayment. But this will decrease your cash on cash return.

Wrapping it up

I hope that this article will be one of many tools in your pocket to help give you a starting place to begin your search for the best Toronto neighbourhoods for condo investors.

Please let me know in the comments if you are currently a real estate investor and how you evaluate potential properties. If you are considering becoming a condo investor, best of luck and let me know how it’s going for you.

Please note that the information here and elsewhere on my blog is for education and entertainment purposes only. Any examples are for demonstration purposes and may not apply to your personal situation.

Wow crazy rents! Things are cooling down here in Vancouver.

Yes. If I get a good response to this article I’m thinking of replicating it for all major Canadian cities (but not by neighbourhood) as a cross-country investment comparison. There’s no reason why you have to live in the city where your investment property is, if the financials are better elsewhere. Even if the financials are the same, a 20% downpayment is a lot more in Toronto and Vancouver than in most other cities, which makes it harder for would-be investors to get started.