I’m so excited to share with you the news that I’ve been nominated for a Sunshine Blogger Award! The Sunshine Blogger Award is an award given to bloggers by other bloggers. It has been a while since I’ve written anything about myself, so here’s your opportunity to get to know me a bit better.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

What is the Sunshine Blogger Award?

The Sunshine Blogger Award is a peer-recognition award given by bloggers to other super creative, talented, and entertaining bloggers. It is an excellent way of opening yourself to the community and your readers and brings overall positivity to the blogging community. It’s a great feeling to know that other bloggers are loving your blog content!

Sunshine Blogger Award Rules

- Thank the person who nominated you. Add back links to their blog.

- Answer the 11 questions they posed to you.

- Nominate another 11 new bloggers and give them 11 new questions.

- Include these rules in your post and use the Sunshine Blogger Award logo in your post.

Who Nominated Me?

I want to thank Kathy at Baby Boomer Super Saver for nominating me! After Kathy realized she wasn’t saving enough for retirement, she really got creative about boosting her savings. Whether or not you’re a Baby Boomer, I highly recommend reading her blog. I particularly like the successful retirement fund catch-up interviews. I find it fascinating to read other people’s experiences and see how they dealt with financial adversity.

Here are the Questions Kathy asked me, and my Answers

1. What is your earliest memory about money?

My Mom was a college math professor (now retired). I remember her sitting at the dining room table, working on lesson plans for her students. The topic that day was mortgages, and she explained how you can save tens of thousands of dollars by paying your mortgage weekly or biweekly, instead of semi-monthly or monthly. You can also pay off your mortgage YEARS earlier by doing this.

Want to know why? Because if you’re paying your mortgage semi-monthly, that’s 24 payments per year. If you’re paying bi-weekly, that’s 26 payments per year. If you pay the same amount, then you’re effectively getting in two extra payments every year!

I was probably about 10 years old when I learned this from my Mom, and it has stuck with me to this day.

2. How much money do you feel you need to have in an emergency fund for yourself or your family? Three, six, or twelve months worth of expenses?

For many years, our family chose to have an emergency plan, rather than emergency fund. That is, if we needed extra funds, we knew where we could access that for a low interest rate – our HELOC. (HELOC stands for “home equity line of credit. It’s a low interest rate loan secured by your house.) Never carry a balance on your credit card, and absolutely never go to a payday loan place.

More recently, we’ve started saving in a high-interest savings account, with about 3 months worth of expenses set aside. Despite paying low interest rates on our HELOC, I always found it vexing that we were in short-term debt at all. It’s truly peace of mind knowing that if we have a moderate unexpected house expense, like last year when we had to replace our furnace and hot water heater, we can do that without incurring debt.

If you’re interested in high-interest savings accounts, I strongly recommend looking at EQ Bank, which is currently paying 1.5% interest. There’s no monthly fee and no transaction fees. They have a great online and mobile app, too.

3. What is your saving rate (amount saved per year divided by your gross income)?

Maybe this makes me a bad finance blogger, but I don’t actually know our savings rate. We contribute a targeted amount to our RRSPs each year. And we contribute the maximum (to get the grant) to the children’s RESPs.

This year, with COVID-19, we have been spending much less than usual. No vacations – well, we went camping once and we rented an Airbnb cottage for Thanksgiving weekend, but both were very inexpensive. No restaurant meals, though we get take-out frequently to help support our local restaurants (and have a break from cooking). No summer camps for the kids. A lot less driving. No public transit. All together, our savings rate for 2020 will be higher than usual.

4. Which is better for getting out of debt – the debt snowball or debt avalanche?

For those who aren’t familiar with these terms, let’s start with a definition:

Debt Snowball – make a list of all your debts. Pay the minimum balance on all your debts. Pay any extra funds to the debt with the smallest balance.

Debt Avalanche – make a list of all your debts. Pay the minimum balance on your your debts. Pay any extra funds to the debt with the highest interest rate.

I recently was invited to write for Dividend Power’s blog on Debt Avalanche vs. Debt Snowball. If you want more information about these two debt repayment strategies, please check it out!

The gist is that Debt Avalanche pays off all your debts a little bit faster, and costs a bit less, because you’re dealing with the debt with the highest interest rate first. However, some people find that Debt Snowball is more motivating, because they get that first quick win by paying off the smallest debt first.

As an analytical person, I’ve got to vote for Debt Avalanche myself. The credit card gets paid off every month, because that would have the highest interest if we carried a balance. Then the line of credit after that.

5. If money was no object, how would you spend your time?

If money was no object – and if COVID-19 was no object – I would spend more time travelling. Especially in the winter. I’m really not a winter person, with those short daylight hours, and all the extra layers that still don’t keep out the chill.

6. Out of the money books, blogs or podcasts you’ve consumed this year, which was your favourite and why?

Big question!

Favourite Money Book

I have read many personal finance books this year, and I think my favourite is “Quit Like a Millionaire: No Gimmicks, Luck, or Trust Fund Required” by Kristy Shen and Bryce Leung. This young Canadian couple, living in Toronto (one of the most expensive cities in Canada) turned their back on the traditional working-to-pay-the-mortgage lifestyle. They accelerated their savings and investing, and now in their 30s they’re retired and travel the world.

Even though it’s far too late to retire in my 30s, I got a lot of value from this book. I particularly liked the detailed description of how they set up their retirement funds so that money needed for short-term spending is guaranteed to be there for them.

Favourite Money Blog

There are so many great personal finance blogs, it’s hard to pick just one favourite! I’m going to recommend that you should check out Tara’s blog, at Our Bill Pickle. She has a great new article on “Five Tips for Building a Realistic Holiday Budget“.

It’s so important not to go into debt by being overly generous or not planning for the holidays! I’ve recently updated my 10-Week Debt-Free Christmas Challenge.

Favourite Money Podcast

I listen to a lot of podcasts. I find it a great way to learn new things while I do household chores, cook dinner, or exercise.

One of my favourites is Explore FI Canada – “FI” being short for “Financial Independence”. The hosts are knowledgeable and have a great rapport.

I had the pleasure of being interviewed by them earlier this year! We talked about RESPs – Registered Education Savings Plans. We covered RESP grants, contributions and investments, plus withdrawals and taxation. You can listen at “All About RESPs part 1” and “All About RESPs part 2“!

7. Has your financial situation gotten better or worse since COVID-19 began?

Our financial situation has improved since COVID-19 began. I mainly work from home as a part-time association manager. Our in-person events pivoted quickly to webinars, and my hours increased. In addition, I got a new job as a manager for a third association. My husband also is able to work from home 100%.

Our spending has also decreased over the year, as vacations were cancelled and plans for summer camp were dropped. We’re ordering meals in more often, but it’s still cheaper than eating at a restaurant – mainly because we’re not ordering drinks I guess, and our choices are less expensive. Pizza is less costly than fine dining.

8. What financial changes would you like to see 12 months from now?

I think we’re currently in a great spot, financially. Looking ahead, I’d like to be clearer on possible big financial changes – should we buy a cottage? Should we start a consulting business? Should we invest in a rental apartment or house? When should we plan to retire?

9. Imagine your future self in retirement – what would you say to your younger self about money?

Be better, sooner, about tracking spending and income.

Don’t financially stretch to buy a bigger house, anticipating higher future income.

10. Why did you start blogging and what is your blog about?

I started blogging because I was looking for a new challenge. I enjoy managing our family’s personal finances, and I thought I could share my experience with others. It turns out that I have also learned a lot from researching as I write my blog!

11. As a blogger, which one of your posts do you feel we should all read?

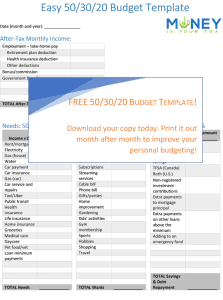

My most popular post is “The 50/30/20 Budget Rule: A Simple Step-by-Step Guide“. The 50/30/20 budget rule was popularized in the book “All Your Worth: The Ultimate Lifetime Money Plan“, authored by U.S. Senator Elizabeth Warren, and her daughter, financial consultant Amelia Warren Tyagi.

The gist of the 50/30/20 budget rule is to allocate 50% of your income to your “needs”, 30% to your “wants”, and the remaining 20% to paying off debt and/or saving.

This post has always been popular amongst my readers, so I decide to make it even more valuable for you by creating a free downloadable and printable 50/30/20 budget template.

Want a copy for yourself? Go to “The 50/30/20 Budget Rule: A Simple Step-by-Step Guide“. I’d recommend reading it, but if you just can’t wait, scroll to the bottom and you’ll see the form to get your free budget template.

I have also written a series of articles on Personal Finance during the Coronavirus Pandemic. Whether you’re in a cash flow crisis, or concerned about a global recession, check it out.

My Nominations for the Next Sunshine Blogger Award

It’s so hard to choose exactly 11 great bloggers to nominate for the next Sunshine Blogger Award! But here you go. Check out these great writers!

- My fabulous cousin, Janine, who blogs about homeschooling and homesteading at Janine’s Place.

- Ling at Finsavvy Panda

- Tara at Our Bill Pickle

- GYM at Gen Y Money

- Jessica at Jessica Moorhouse

- Kristy Shen at Millennial Revolution – the author of “Quit Like a Millionaire: No Gimmicks, Luck, or Trust Fund Required“

- Court at Modern FImily

- Steven Arnott at the Snowman’s Guide – author of The Snowman’s Guide to Personal Finance – Check out my post The Snowman’s Guide to Personal Finance – Interview with Steven Arnott!

- Matthew at All About the Dividends

- Sarah at Smile and Conquer

- Maria at Handful of Thoughts

Questions for my Nominees

- Coffee or tea?

- We’ve all been spending more time at home during COVID-19. What’s a favourite or new recipe that you’d like to share? (You can link to a food blog if you wish.)

- Why did you start your blog?

- If money were no object, how would you spend your time?

- What is one money tip you would like to share with your children (or other people’s children)?

- What is the one thing you would most like to change about your finances?

- Has COVID-19 affected your personal finances?

- I recently paid only $80 for a new $450 printer. Tell us about an experience you had where you got a great deal, and how you managed it.

- Do you know your credit score?

- What is your favourite personal finance blog, podcast or book?

- As a blogger, which of your posts do you think we should all read?

Soooo…I am super behind on everything online (thanks, day job!) which means I am JUST getting around to commenting on this — thanks for the shoutout and the nomination – you are TOO sweet, my friend. I swear I am going to get to putting mine together ASAP (crossing all my fingers that work is going to slow down soon…at the very least, I will have some vacation eventually, which I am SO jazzed about).

If it helps…I don’t know what our saving rate is either 😡 To be fair, though, I think a lot of it for us has to do with the fact that we are still in debt-pay-off mode.

On the snowball vs the avalanche — we went with the snowball…but it sort of also ended up being the avalanche? In that our debts went from smallest with the highest interest rate to largest with the lowest. I hadn’t really thought too much about that until reading this. Funny haha.

Thanks for the nomination Kari! I’ll work on your questions shortly 🙂

I enjoyed getting to know more of your story, Kari. I also agree with you about debt pay down—I’d also pick the avalanche method, hands-down!

Thanks so much for the shout-out (and once again, thanks for coming on the show)! We’ve got a nice little personal finance community here in Canada!

Hi Kari – I would like to thank you for your 50/30/20 budget planning sheet. We are currently going thru retirement income which is a whole different ball game than work with money coming monthly and we want to know if it’s smart to invest in a benefits plan. So this sheet has really helped with that. Thanks again!

Thanks, Sheryl! I’m sure it’s a whole new mindset going from budgeting with money coming in each month, to budgeting with your life savings.