Knowing your credit score is your secret weapon to helping you get the lowest interest rate on your mortgage, car loan, or other borrowing. It will help you be approved for a credit card with the best reward offers. And its partner, your credit report, can alert you to any fraud or identity theft if they take out a loan in your name.

If you’ve never checked your credit score, you’re not alone. But with free access through Borrowell and Credit Karma, it has never been easier. If you think your credit history is not great, checking your score regularly is the first step to improving it. In a recent Borrowell study, they found a correlation between the frequency of credit monitoring (how often a person checks their credit score) and credit improvement over time.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

Credit Reporting Agencies in Canada

There are two credit reporting agencies in Canada: Equifax and TransUnion. They receive regular reports from lenders and others regarding your credit information. This can include your mortgage, credit card payments, phone bill, and more.

They each compile a credit report, listing current and past loans, credit cards, and more. And they each create a single “credit score” based on all the information in the report.

According to the Canadian Kilometers blog, about half of the banks and credit card companies report to Equifax, and half to TransUnion.

Each of these companies charges about $20 per month for a subscription to their services.

On the other hand, you can check your Equifax credit report and credit score for FREE with Borrowell! Sign up for your free credit score and report.

Borrowell helps people make great decisions about credit. With its free credit score and report monitoring, automated credit coaching tools and AI-driven financial product recommendations, Borrowell empowers consumers to improve their financial well-being and be the hero of their credit.

Borrowell

Information Included in your Credit Report

The report begins with the date your credit file was opened with Equifax. For me, this was probably when I got my first student credit card. It also includes the date your credit report was last pulled. This will be today, when you sign up.

Your credit report contains information on any open or closed accounts on file:

- Revolving credit – you have a credit limit and can borrow up to that amount (e.g., credit cards, lines of credit)

- Instalment loans – you have a loan that has regular fixed payments (e.g., car loan, student loan)

- Open accounts – companies that you have a commitment to regular payments (e.g., mobile phone accounts)

- Mortgage

Credit Inquiries – Do they Affect my Credit Score?

It also includes any credit inquiries on record. Credit inquiries are when someone requests to check your credit. Hard inquiries are made when you apply for credit with a company, and they want to review your credit as part of their decision making process. Having a lot of hard inquiries may affect your credit score.

Soft inquiries are when you are checking your own credit score, including when you use a free service such as Borrowell. Soft inquiries do NOT affect your credit score.

Only hard inquiries will appear on your credit report.

Other Information on your Credit Report

- Collections – if you have any overdue credit that has been sent to a collections agency, it will appear here. This can have a strongly negative effect on your credit score.

- Legal items – any court judgments or other public records relating to your credit are shown here.

- Bankruptcies – if you have ever filed for bankruptcy.

Help! My Credit Report has an Error!

It’s very important to check your credit report on a regular basis. There could be many discrepancies on your report that you should address right away.

In a worst case scenario, if your identification has been stolen, your credit report may show that they have tried to open (or have succeeded in opening) credit cards or loans in your name.

In addition, if you closed an account or paid off a loan it should indicate that on the credit report. But in a few cases it may still show as open.

Negative information on your credit report drops off after a number of years, so if it still appears you should ask to have it removed from your credit report.

You may also find that you made a payment on time but your credit report shows it as being late. Or you may find errors in your mailing address or personal information such as your date of birth, that needs to be corrected.

In any of these cases, contact Equifax or TransUnion right away with details of the error and any supporting documents required to show the correction.

Moreover, if you know your identity has been stolen, your wallet has been stolen, or there has been a break-in at home, alert both credit bureaus right away. A fraud alert will notify potential lenders to contact you and confirm your identity before approving any new credit applications.

Credit Score

Your credit score will help others decide whether to give you a credit card, lend you money and at what interest rate, rent you an apartment, and more. Lenders want to ensure that they work with individuals who will pay their bills on time.

Your credit score is not the only factor they will use. For instance, they may also want to know that you are employed and what your income is.

How are Credit Scores Calculated

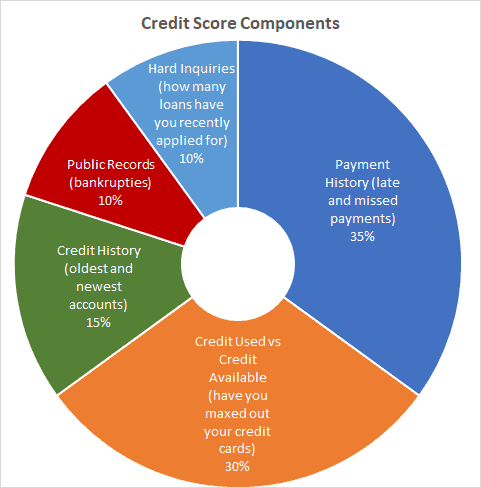

Equifax shows the following breakdown of how they calculate your credit score:

- Payment history (~35%) includes late and missed payments, items in collections, how recently and how often you miss payments, and how much was owed.

- Credit used vs credit available (~30%) includes how much you owe on credit cards and lines of credit vs your credit limit. That is, have you maxed out all your credit cards.

- Credit history (~15%) includes how long your oldest and most recent accounts have been open, so creditors can see that you can handle credit over long time periods.

- Public records (~10%) includes any bankruptcies or collection issues.

- Inquiries (~10%) includes only “hard inquiries” by potential creditors to access your credit files. Applying for many loans in a short period of time may be an indication of financial distress.

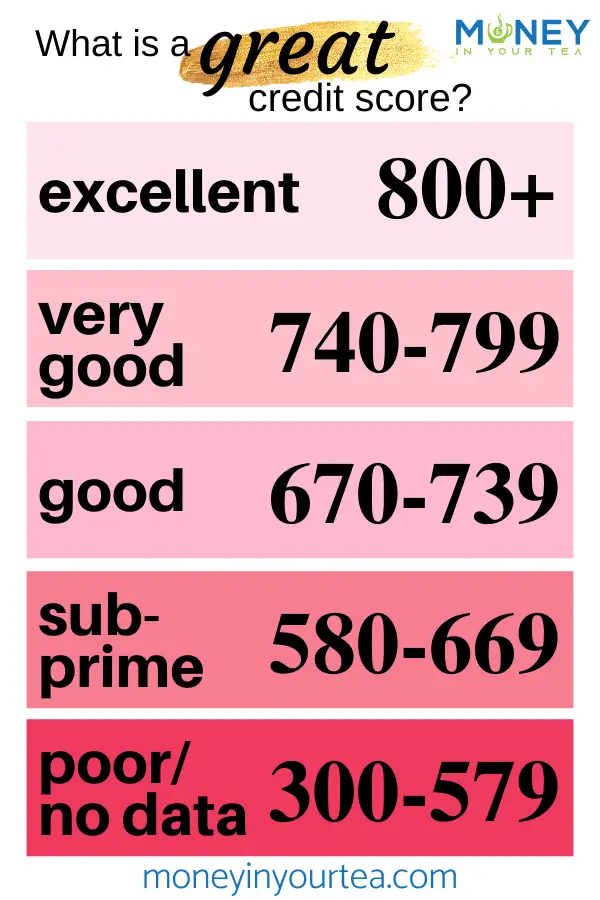

What is a “Good” Credit Score?

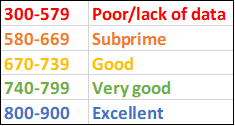

Credit scores range from 300 to 900. According to Equifax, a score in the 300-579 range is generally considered poor credit risk, or there is just not much data because they are a new borrower. Scores between 580 and 669 are subprime borrowers, and may have to pay higher interest rates if they can get a loan.

If your credit score is 670 to 739, that is considered good. 740-799 is considered very good, while 800 and above is excellent.

Related reading: Learn how to build your credit history with The Essential Beginners’ Guide to Credit Cards

Why your Credit Score Matters

Loans and Mortgages

On a day-to-day basis, your credit score doesn’t really matter that much. It’s nice to check and see you have a good (or excellent!) credit score. And a great feeling to see your credit score rise over time.

But when it really matters to have a very good or excellent credit score is when you’re applying for a loan or mortgage. This can include a car loan, small business loan, and more.

A higher credit score for you – above 720 – means that the lending company is taking less risk to let you borrow funds from them. They have greater trust that you will pay your loan in full and on time each month because they can see that you already pay your existing credit that way.

In return, they are more likely to lend you money at their best interest rates. They will also feel more comfortable lending you larger amounts of money, or giving you a loan without requiring a guarantor or co-signer.

Related Reading: How Much House can you Afford?

Other Ways a Poor Credit Score can Hurt you

Potential landlords may also check your credit score, and can refuse to rent an apartment to you if they questions your ability to pay the rent on time based on your credit history.

When you sign an application to rent a car, the rental agency may check your credit score, according to Debt Canada. Even though you are not applying for credit with the car rental agency, the application may include this clause.

Potential employers may also ask to check your credit score, and could refuse to hire you based on your bad credit history.

Utility companies can check your credit history, and may ask for a security deposit up front before connecting your electricity, gas, etc.

A low credit score may result in you being unable to get a cell phone contract. You may be forced to choose between a prepaid cell phone or no cell phone at all.

How to Check your Credit Score for FREE

Equifax and TransUnion both charge about $20 per month for a subscription, which includes your credit report and credit score.

On the other hand, you can get a FREE credit report and credit score from Borrowell, which is based on your Equifax information.

You can also check your credit score from TransUnion for free with Credit Karma. Your two credit scores may be slightly different because some banks and credit cards report to Equifax, and others to TransUnion. But they should be fairly close.