All women know that we need to save for retirement. But did you know that as women, we need to save MORE for retirement than men? The standard rule of thumb is to set aside 10% of your pre-tax income in your retirement account. But this advice isn’t enough for most women! Let’s take a look at the reasons behind the gender savings gap and what we should do about it.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

Women Live Longer than Men

Worldometers reports the life expectancy of men and women in 191 countries. In every case – without exception – women on average outlive men by several years. The average life expectancy is 84.7 years for women and 81.1 for men in Canada. In the U.S. it’s 81.7 and 76.6 years, respectively. On average, women outlive men by about 5 years.

Looking at the standard retirement age of 65, Canadian men can expect about 16.1 years of retirement, whereas women have 19.7 years. For Americans, this gives 11.6 years of retirement for men, and 16.7 years for women.

That implies that Canadian women need to make their retirement funds last more than 22% longer than men! And American women have a whopping 44% longer retirement than men!

This also implies that if the “save 10% of your before-tax income” rule was developed base on American life expectancies, then Canadians may be at risk of outliving their money. That’s a bit off-topic, so perhaps worth exploring in the future.

More Women Take themselves out of Full-Time Work

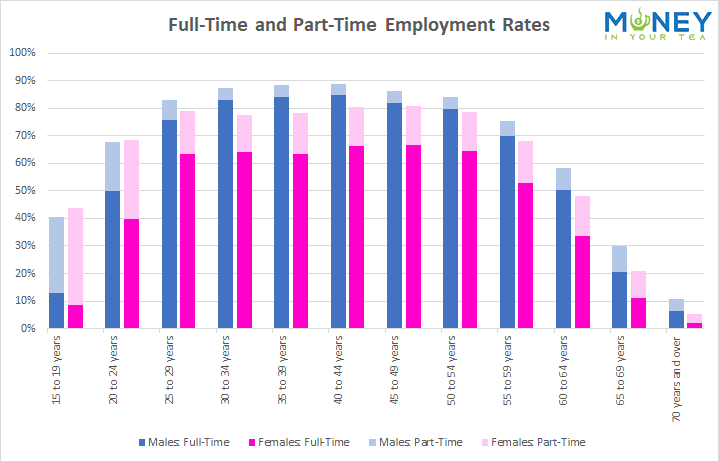

It’s probably no surprise that even in the 2020s more women are taking time out of their careers for childbirth, childcare, and eldercare. And the data shows this is true. The following chart shows full-time and part-time employment rates for men and for women by age. (The data is for 2018, the most recent Statistics Canada has online.)

It is easy to see that women age 30-34 and 35-39 are about 10% less likely to work than men of the same age groups. Moreover, of those who are working, women are more likely to be part-time than men of the same age.

The employment gap starts to narrow as women get a bit older (presumably the kids are in school now). But notice how the rate of employment for women falls below that of men in the over age 60 groups. Perhaps women are leaving work to care for aging parents and in-laws.

To the extent that women may marry men slightly older than themselves, women may also be retiring when their husband leaves work. If he’s 65, she may be leaving work in her early 60s.

How does this Impact our Finances?

This has several implications for women’s earnings. Our income is lower or zero in the years we are not working. Setting aside 10% of $0 income is still $0. Or 10% of a woman’s part-time earnings will mean less going into your retirement account than 10% for a man earning full-time income. Moreover, we may lose out on workplace pension earnings over these years. And it can impact your future government retirement benefits that are based on income.

Let’s see how taking a year off work when a woman has a baby impacts her retirement savings. If a woman foregoes one year of contribution to her retirement account at age 30, the difference in her retirement portfolio at age 65 is astounding. For example, if she would have typically contributed $10,000 to her retirement account and her investment earns an average of 7% per year, at age 65 her retirement portfolio will be $107,000 less! If she misses that $10,000 contribution again at age 35 when baby #2 is born, her portfolio at age 65 will be down by another $76,000!

Gender Pay Gap

When women take themselves out of full-time work during the childbearing years, we significantly reduce our earnings. Not only in the years we are not working, but we also forgo raises and promotions during that time.

When we return to work, even if it’s full-time in the same position, we are a year or two – or more – behind men of the same age and starting time. Since you can’t make up lost experience, women never really make up this gap, and our earnings may never catch up.

And for the women who are working part-time, their income is a fraction of what it would be for full-time employment in the same field. When you’re setting aside 10% of your income, this will make a huge difference in the value of your retirement portfolio. And this compounds over time.

The following chart from Barron’s shows how these career breaks leave women with a large gap in our cumulative lifetime earnings by age 65.

Looking for more Information on the Gender Pay Gap?

The gender pay gap also includes a number of other factors, such as being indigenous, a visible minority, or a new immigrant. The gender pay gap exists even when comparing full-time women to full-time men or adjusting for the same number of hours worked. No matter how you look at it, women need to save more for retirement than men to offset these low earning years.

Digging into all the reasons for the gender pay gap would be an article for another day. Check out the Canadian Women website for more information if you want to dig into this some more. Suffice it to say, women on average will earn less over their lifetimes. Since expenses in retirement would be the same for women and men, women must set aside a higher percentage of their income in order to end up with the same size nest egg at age 65.

Women Marry Older Men

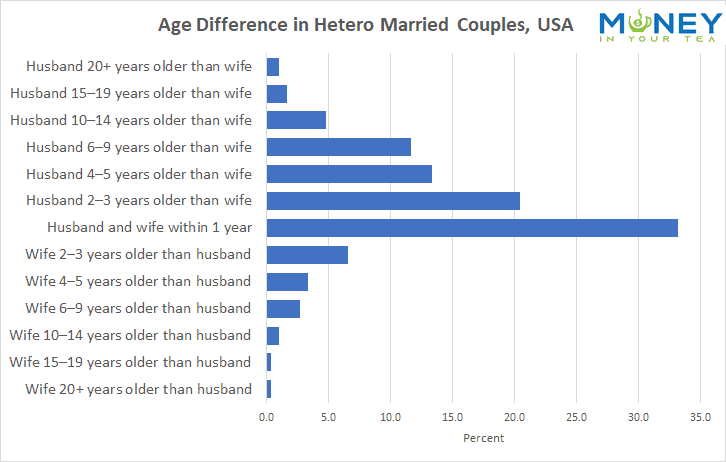

In heterosexual married relationships, it is still the norm for women to marry men older than they are. The following chart, showing data for the U.S.A., illustrates that 52% of husbands are 2 or more years older than their wives.

Remember that women typically experience a longer life expectancy. So women who marry older men are more likely to have many years of widowhood. If the husband had a work pension that the couple relies on for retirement income, this could be diminished or end completely at the point of his death. And while some expenses might fall (food costs, for example) others will stay the same or rise over time (such as property taxes).

In addition, end-of-life care can be very expensive. This can leave a woman with substantially lower savings by the time her husband passes. Women need to save more for retirement than men, to account for these years of anticipated widowhood.

Do Women have Lower Investment Risk Tolerance?

There are many online opinions on investing differences between men and women. Some feel that this makes women better investors, on average. While others indicate that women are less likely to invest, and get lower investing returns.

A sample of recent headlines includes:

- A new study suggests male investors are prone to panic, while women play it smart, by Quartz at Work. It concludes that women are more likely to self-identify as low- or medium-risk tolerant, but their investing behaviour is much the same as men. However, they are less likely to panic sell investment in a market downturn.

- Do women really make better investors than men?, by the Financial Times. The conclusion is that fewer women invest than men, but that they generally outperform on returns.

- Examining Male vs. Female Investment Behavior, by SoFi. This reports that women hold 71% of their assets in cash, as compared to 60% for men. This can feel secure, but can decrease in value over time due to inflation and has little opportunity for growth. Among millennials, 14% of men report that they “embrace risk” in their investment portfolios, as compared to 7% of women.

The evidence is mixed about whether women make better investment decisions or play it too safe. However, if YOU feel more comfortable with lower risk investments, you need to save more for retirement.

How can Women Save More for Retirement?

We’ve looked at five important reasons why women need to have a higher savings rate for retirement than men. But knowing this is the first step in making the changes to avoid financial stress in retirement. But what else can we do?

Read and Learn

The most important action we can take is to read and learn about saving and investing for retirement. Follow personal finance blogs (like mine)! Read books on investing for beginners, or finances in retirement (check out some of my favourite personal finance books). If you are not comfortable with DIY investing, find a fee-for service advisor to help you make decisions you are comfortable with.

Prioritize your Retirement Savings

Put your savings into your retirement fund before anything else, such as the kids’ education funds. If they need to get scholarships, enroll in a less expensive program, or work part-time jobs to graduate with less debt, so be it. They’ll graduate at 22 and have their whole lives to earn. You don’t want to retire at 65 without enough to live on, and hope that the kids will support you.

Save MORE than 10% of your Pre-Tax Income

Consider setting aside 15-20% of your pre-tax income into your retirement investing accounts. The paper Gender Retirement Gap suggests that 18% of pre-tax income is the “right” number. Give that savings rate another big boost in the year before you plan to take time off to have a child, if you can. Think about the dollar amount you need to save, as well as the percent of pre-tax income.

Start Saving Younger

Women can start saving for retirement when they are younger, anticipating that they will need to save more for their retirement than men over their lifetimes.

Choose your Employer Strategically

Women, more than men, are likely to work for companies without employer pensions or other benefits. Consider a career choice where you work for a company that has maternity leave top-ups, employer contribution to a pension or retirement plan, insurance coverage, or other benefits.

Think Intentionally about your Career when you Take Time Off

If you are taking a few years out of the full-time workforce when the kids are born, think strategically about this. Keep in touch with key people in your field. Consider working part-time or occasional shifts with your former employer. This will help keep you in line for promotions and raises. Have a plan for what happens with your career when the youngest kid is 5 or 10 years old.

Spousal Retirement Plan

If you are taking time off when the children are young, or to care for aging parents, have your partner contribute to your spousal retirement plan as well as his own. This will keep your retirement investment fund growing.

Invest a Little more Aggressively

It’s very important to invest within a risk profile that you are comfortable with. Investing in risky assets that keep you up at night worrying, is not worthwhile. That said, women can learn more about investing in order to feel comfortable putting a little more in equities. And by “risky”, I don’t mean investing in cryptocurrencies! I mean a solid ETF index fund that tracks the broad stock market. Over time, equity investing returns about 7-8% per year, as compared to about 2% for a guaranteed investment. Keeping in mind that inflation is also about 2%, you’re really not getting ahead by saving this way.

Insurance Coverage

Talk to an insurance broker about the right types and amount of insurance to buy for yourself and your partner. If your partner could no longer work or if you were widowed, insurance can protect you financially.

Retirement Withdrawal Strategy

If you haven’t had any professional financial advice from a fee-for-service planner, now is the time. Book a one-time appointment to have someone go over your financial assets and help develop a withdrawal strategy. S/he will ensure you are invested appropriately for this life stage. The years where you draw down your money are very different than the years you spent building it up. S/he will help you decide when is the right age to apply for government benefits, set up an annual spending budget, and plan for large one-time expenses like replacing your car. S/he can also look at what happens to your finances when one spouse passes away.

The rule of thumb for saving 10% of your pre-tax income for retirement isn’t enough for women. Women need to save more for retirement than men. Start early, save more, learn to invest in equity comfortably, get advice when you need it.

I have zero surprise that I will have to save more for my retirement than my husband. Lame! Oh well, I appreciate the data. I shoot for 15% of retirement contributions but looks like I should be shooting for more! Happy health and savings!