Discover the top personal finance deals especially for Canadians! Optimize your finances and save money at the same time. Make your savings accounts pay higher interest. DIY or managed investing is easy and cheaper. Get a free credit score and credit report. Find the latest credit card promo deals to suit your needs. Save money by doing your own income taxes this season. Pick up one of the bestselling personal finance and investing books from Amazon or Indigo to learn from the best.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

Saving your Money

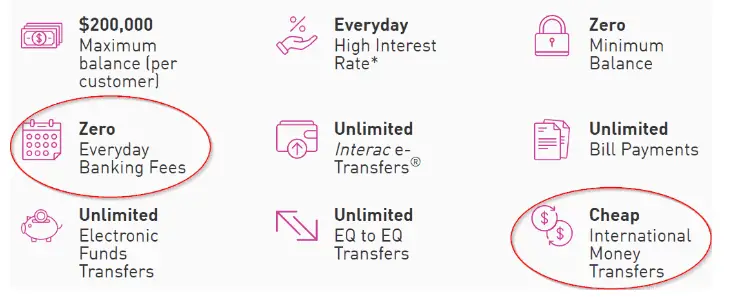

Put your emergency fund and other savings to work for you. EQ Bank has long been one of the industry leaders in high interest rate bank accounts, with a 1.50% everyday interest rate*!

But unlike some of the other online banks, with EQ Bank there are no limits or penalties for accessing your own money when you want it. You can get this everyday 1.50% interest rate* with the flexibility a chequing account for everyday banking such as paying bills and transferring money, without any hassles. Plus, transfer your money when you need to – with free Interac e-Transfers® and Electronic Fund Transfers.

EQ Bank legal footnote: *Interest is calculated daily on the total closing balance and paid monthly. Rates are per annum and subject to change without notice.

Investing your Money

What is the difference between self-directed and managed investing?

With self-directed investing, you’re managing the investments yourself. You choose what to buy and when to sell, how much in this or that. You monitor it yourself. Because you are doing all the research, the fees are lowest for this option.

With managed investing, your money is actively managed by a team of experts. Portfolio managers adjust your investment mix to reduce risk while maximizing gains. When market conditions change, your portfolio is rebalanced to keep it on track. Advisors are available for you to ask questions.

Questrade offers you both options, at a great price. They are Canada’s fastest growing online brokerage. And with lower overhead costs than bricks-and-mortar brokerages, they can pass those savings on to you through lower fees. Questrade has a great online website to track your investment portfolio. Or trade on-the-go with the Questrade app.

They offer great support, too, with on-demand webinars and retirement planning advice.

Self-Directed (DIY) Investing with free ETF Purchases

Questrade Self-Directed Investing offers free ETF purchases, so it’s easy to see why they are so popular. There are no account opening or closing fees. And no annual RRSP or TFSA account fees. You can invest in stocks, bonds, mutual funds, ETFs, options, precious metals, and GICs.

Low-Priced Worry-Free Managed Investing

Not comfortable yet with DIY investing? No problem! Managed investing with Questwealth is still a great deal! They’ll ask you a few simple questions about yourself and your financial goals, then recommend a customized portfolio based on your responses. When life changes – you buy a home, have a baby – let Questwealth know and they’ll adjust your portfolio to suit your new circumstances. Best of all, your dividends are automatically reinvested so they start growing right away.

Which is Right for Me?

Can’t decide between DIY investing to save money, or wanting a little advice to get started? My suggestion would be to start off with Questwealth for a year or two to get familiar with investing. When you’re feeling more confident, then switch to Questrade self-directed investing at that time. They would be more than happy to assist you with this.

FREE Credit Report and Credit Score

Knowing your credit score is your secret weapon to helping you get the lowest interest rate on your mortgage, car loan, or other borrowing. It will help you be approved for a credit card with the best reward offers. And its partner, your credit report, can alert you to any fraud or identity theft if someone takes out a loan in your name.

Borrowell helps people make great decisions about credit. With its free credit score and report monitoring, automated credit coaching tools and AI-driven financial product recommendations, Borrowell empowers consumers to improve their financial well-being.

Is it really free? Yes. Borrowell makes money by occasionally suggesting other great financial products for you. If you take one of their recommendations, that company pays them a referral fee. Not interested? No problem! You still get your free credit score and credit report monitoring. I’ve signed up myself, and they only send a recommendations email about once a month. You can even unsubscribe if you don’t want to receive these emails.

And it’s pretty fun to get emails like these: Congratulations Kari, your credit score has increased!

DIY Income Taxes

I’ve done my own taxes since I was a teenager, and it’s never been easier than with software from TurboTax from Intuit. Complete your income taxes online or offline. With specialized software for simple situations, ranging up to self-employed, or incorporated business, they have a range of options. TurboTax also offers fabulous support if you have questions while preparing your income taxes.

Even if you don’t do your own taxes, don’t take the “instant tax refund” offered by those popular tax preparation companies. They can charge up to 15% on the first $300, and 5% on the rest. On a $1,000 tax refund, that’s $80 in fees! And you’ll likely get your full refund from the government within a couple of weeks anyways. Check out my article 9 Brilliant Ideas for your Tax Refund!

Learn More About Personal Finance

I’ve written a number of reviews about personal finance books. You can find them here:

- The Most-Wished-for Personal Finance Books for Christmas 2019 (still relevant, even if it’s not Christmastime)

- Read Your Way to Wealth a review of the top finance books I’ve read lately

- STANDUP to the Financial Services Industry – Book Review

- The Latte Factor versus Smart Women Finish Rich, two of David Bach’s best personal finance books

- Broke Millennial – Book Review a great book for Gen Z, too

It’s so important to learn from the experience and expertise of others! With every personal finance book I read, I continue to learn new things and different approaches. You can pick these great books and more from Amazon or Indigo Canada. They also make great gifts for new graduates, weddings, baby showers, new homeowners, recent retirees, or anyone interested in learning more about financial planning and investing.

Links to Amazon above, and Indigo Canada below.

Optimize your Credit Cards

Have a good look at what credit cards you are using. If you pay a fee for your credit card, are you really getting the most benefits from it? This is a complicated topic, more than I can dive into here. I will say, though, that I use the BMO® AIR MILES®† World Elite® Mastercard® as my main credit card. We earn over 10,000 Air Miles each year. If we take it as Air Miles Cash, that’s equivalent to over $1,000.

I would also recommend a second no-fee credit card from a different company. This is NOT in case you max out the first one! This is when you go somewhere and your tap or stripe doesn’t work, or they don’t take the brand of card you have (Mastercard, in my case), or your card is stolen (virtually or physically). We recently switched to SimplyCash™ Card from American Express.

And remember to read the coverage that comes with your credit card! Many credit cards will give you added purchase protection if something you buy breaks. And they also often cover rental car insurance and/or travel medical insurance, so be sure to read it over before you go on a trip. There’s no point in paying for insurance you already have.

Find the right credit card deal for you!

Track your Financial Goals

Accomplishing a goal often starts with writing it down. Keeping it in front of you helps to maintain the motivation to go through the hard work! I love the personal finance printables and debt trackers from Etsy. Want more info? Check out my article on achieving your personal finance goals!

This Etsy bestseller is particularly lovely, and covers a wide range of topics. It includes trackers for income, expenses, bills, savings, donations, debt repayment, and more! It’s a bargain at well under 50¢ per page.