Dollar cost averaging (DCA) is an extremely popular investment strategy. By investing the same amount each month, you can potentially reduce the impact of stock market volatility on your portfolio. No one wants to invest a large amount of money, only to have the stock market plunge shortly thereafter! It is also known as the constant dollar plan, because you invest the same dollar amount each month.

From time to time I invite other writers to share their expertise with you. This is a guest post from Passiv, a software company that helps DIY investors grow and manage their wealth at online brokerages.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

How to Use Dollar Cost Averaging to Manage Your Investments

Dollar cost averaging is a simple strategy that many investors use to manage their investment portfolios.

While the strategy is fairly simple, it can be very powerful when combined with a sound long-term investment plan.

This article will teach you everything you need to know about dollar cost averaging. Specifically, you’ll learn:

- What dollar cost averaging is

- The benefits of dollar cost averaging

- The downsides to dollar cost averaging

- How to implement dollar cost averaging with Passiv

What is Dollar Cost Averaging?

Dollar cost averaging is simple yet powerful.

It involves investing the same amount of money into specific assets each month, regardless of the price at which those assets trade. It is called dollar cost averaging because it aims at reducing the average price of the assets you buy.

To help you understand, let’s consider an example. Imagine that you want to invest $500 per month into Apple (AAPL) common shares.

In December, Apple trades at $96. This means you’d have enough money to buy 5 shares of apple.

The next month – January – Apple trades at $105. This means you’ll only be contributing enough money to buy 4 shares of apple.

If the price went down the following month – Apples trades at $85. The remaining money (about $80) could be used with your next month’s $500 contribution and you’d be able to purchase 6 shares of Apple.

By using this strategy, you can buy more when the price is low, and less when the price is high, reducing your average price.

As you can see, the core concepts within dollar cost averaging are fairly simple. However, the strategy has a number of benefits. We will discuss the benefits of dollar cost averaging in the next section of this article.

The Benefits of Dollar Cost Averaging

As mentioned in the introduction to this article, dollar cost averaging is used by investors around the world to manage their portfolio. We’ll now discuss why you might benefit from using dollar cost averaging today.

First of all, dollar cost averaging makes it easy to save money. Banks and brokerage accounts allow you to set up regular, pre-authorized contributions to your investment accounts, which means you can automate much of the administrative work associated with managing your own investment portfolio.

Dollar cost averaging also has other benefits. Namely, it allows you to capture better prices during periods of market volatility.

To help understand why, let’s consider a simple example. Imagine that you’re a busy medical professional working during March 2020 – when the onset of the coronavirus pandemic in North America caused global stock markets to plummet.

That market correction provided some exceptional buying opportunities for long-term investors. However, as a medical professional, you were busier than ever, and did not have time to pay attention to the movements within the stock market.

If you had implemented a dollar cost averaging strategy, that wouldn’t have mattered. Your periodic contributions would have still been executed. Moreover, your contributions would actually have bought more share of the securities you’re buying – since their prices were lower!

As you can see, there are distinct benefits to using dollar cost averaging to manage your investment portfolio. In the next section, we’ll juxtapose this by talking about some downsides to dollar cost averaging.

The Downsides to Dollar Cost Averaging

As with most investing strategies, dollar cost averaging is not purely beneficial. It also has a few downsides.

Namely, dollar cost averaging takes away your ability to attempt to time the markets. If you are confident in your abilities to follow the business news and economic cycle such that you can invest your money when prices are depressed, then dollar cost averaging is probably not a suitable strategy for you.

On the other hand, there is plenty of academic research to suggest that timing the market is very difficult. While certain market participants like Warren Buffett or Bill Ackman have demonstrated this ability in the past, it is very rare. Dollar cost averaging is likely a much more suitable solution for most investors – especially if investing is not their full-time job.

How to Implement Dollar Cost Averaging Using Passiv

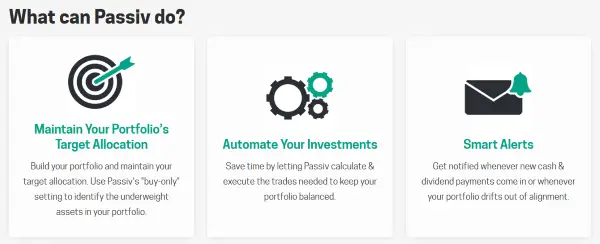

Passiv makes it easy to implement a dollar cost averaging investment strategy in your investment account.

Here’s how it works:

- Set up a regular, pre-authorized contribution to your Questrade account

- Link your Questrade account to Passiv

- Set a target portfolio in Passiv

- As your monthly contributions are deposited into your Questrade account, Passiv will send you emails prompting you to log in and rebalance your portfolio with one click!

Best of all, Passiv Elite – our paid offering that provides advanced functionality like one-click trades, multi-account portfolios, and advanced currency handling – is free for Questrade clients. Just link your Questrade account to Passiv, and you’ll be prompted to upgrade at no cost!

Final Thoughts

Dollar cost averaging is a simple strategy that many investors use to manage their self-directed investment portfolios.

It involves investing the same amount of money into specific securities each month, regardless of the prices at which those securities are trading.

Dollar cost averaging allows you to systematically invest through periods of market volatility. However, it also removes any chance you might have to attempt to time the stock market. It’s not very suitable for people who’d like to make active investment decisions because of this.