Canadian investors in 2022 may worry about a stock market downturn. Investing this year feels more choppy and complex than in the recent past. And yet, with high inflation this year, holding your funds in cash is a losing alternative.

Generally, any investment comes with certain risks, and that’s why it is always wise to take your time to research before committing to a certain investment. In 2022, things have not changed, and millions of people are still buying stocks in Canada to protect their wealth from inflation and maximize their returns.

The Canadian stock market is a better choice than U.S. equity markets

The 2022 stock market outlook is uncertain. However, the Canadian stock market may offer a more solid investment option than the U.S. market. The S&P/TSX Composite Index or Toronto Stock Exchange is the largest securities trading platform in Canada, and the third largest in North America.

One sector particularly worth highlighting are the Canadian banks. None of the banks in Canada had major trouble from the sub-prime mortgage lending scandal faced by the United States. American banks sold too many mortgages. When house prices fell, it resulted in mass loan defaults. This spread across the U.S. stock market, including mutual funds, pension funds, and resulting in a deep recession.

Inflation means leaving your investments in cash is suboptimal

Currently, inflation worldwide is rising, particularly in the United States and Canada. Leaving your money as cash in the bank with a low interest rate means losing money over time. Inflation affects the value of your money. In the future, the money you thought was a lot could end up not being enough.

If you have $1,000 in the bank earning 1% interest, in a year it will be worth $1,010. But if inflation is 5%, groceries and other products that cost $1,000 today will cost $1,050. Your purchasing power has gone down.

Stocks are among the best investment for 2022 to protect yourself from inflation. Putting your money in stocks requires some understanding and research.

There is never a wrong time for buying shares in Canada. Buying stocks has many advantages, which include:

- Your wealth grows as the economy grows.

- Stocks are easy to buy, and you don’t need to be a finance expert to purchase them.

- Buying stocks helps you stay ahead of inflation.

- Buying stocks in Canada does not require you to be a millionaire; you can start with a small investment.

- You get to receive dividends when the company you buy stocks from makes profits.

- Stocks are always easy to sell whenever you want to sell.

- If you feel like the stock market is not going the way you had planned, you can always sell your shares and invest in another way.

Buying stocks in Canada 2022: how to use a broker

The first step is to learn how and where to buy stocks.

To start buying stocks, follow the following steps:

Open a self-directed brokerage account

A self-directed brokerage account gives you complete control over how you invest your money. You may invest in stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more.

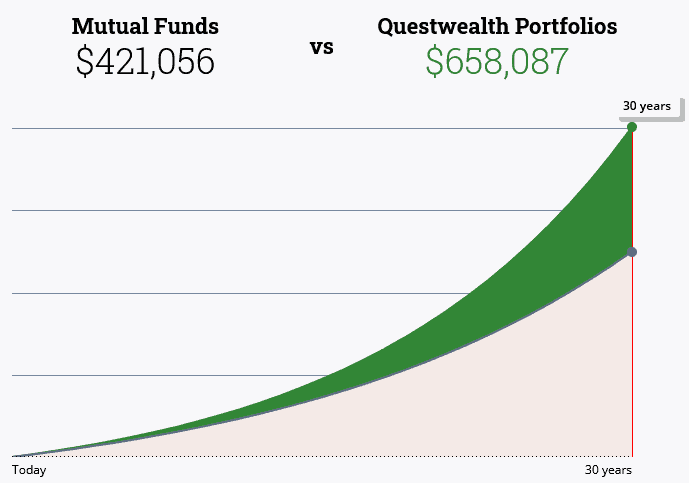

Using a self-directed brokerage account also has the benefit of being a low-cost way to invest. Avoiding high-cost mutual funds and management expenses means more of your money working for you.

Online brokerage platforms in the country are usually independent, but big banks own some.

Choose the right type of investment account for your needs

In Canada, you can invest in registered accounts such as Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP), and Registered Education Savings Plan (RESP).

You can also invest in non-registered accounts. In general, it’s best to use up all your contribution room in your tax-sheltered accounts before investing in a non-registered account.

As the name implies, an RRSP is intended for you to put your money away until you retire from working. In most cases, there are government penalties for taking funds out early.

The TFSA is a good choice for those who want to invest but don’t want to wait until retirement to access their funds. However, the amount you can invest is subject to an annual limit.

And RESPs are mainly for saving for your children’s post-secondary education.

Learn more about TFSAs versus RRSPs and which is right for you.

Analyze your chosen stocks and invest

After you decide what type of account is right for your needs, make sure to learn more about the stocks you are about to invest in. This will be based on your portfolio strategy, such as what type of asset classes you would like to invest in, your time horizon, or your risk tolerance.

Advanced investors will research company data to determine the financial health of the company and its potential growth. You can use the company’s public information, such as balance sheets and cash flow statements to do an analysis. Some investors may do technical analysis, using charts and historical price patterns to predict the future price of the stocks.

This can be overwhelming for the majority of investors, and isn’t really necessary. Novice or “couch potato” investors can purchase exchange-traded funds (ETFs) through a self-directed brokerage. ETFs are like a basket of stocks of many different companies. You only need to buy one ETF in order to own shares in dozens if not hundreds of different companies.

The best brokerages in Canada

The next step is deciding which Canadian discount brokerage is right for you.

Questrade

Questrade has been voted the best online broker for trading in Canada and the U.S. Many people find it easy to trade with Questrade and consider their experience with the platform seamless.

Questrade offers a variety of tools to use, and their commissions are very competitive. Questrade’s customer support is top-notch, so you can always be sure to get assistance whenever you are stuck with anything. It’s easy for Canadians to open accounts and enjoy low withdrawal fees.

You are required to have a minimum of $1,000 in order to begin investing. You can deposit funds in several different ways, including directly from your bank account.

Qtrade

For any beginner focusing on the Canadian market, Qtrade is one of the finest options you can use for trading. It is considered safe, thanks to its long track record, high-level protection for investors, and top-tier regulation.

Its trading fees are quite affordable. Setting up a new account is straightforward and fast.

Qtrade offers high-quality tools, and it is one of the best options if you want to conduct portfolio analysis of some companies. With Qtrade, you don’t need to meet a minimum deposit amount, so you can start investing from as low as $1.

The only major problem with the platform is you cannot use your credit cards or e-wallet to make your deposits.

Interactive Brokers

Interactive Brokers is one of the largest stock brokerage firms not only in Canada but also in the entire world.

It is convenient and offers competitive rates. It offers a large investment selection, comes with high-quality tools, and you don’t need a minimum amount to trade with the platform.

However, it is not the type of online brokerage firm you want to start with if you are a beginner. Interactive Broker is a bit complicated for beginners. Reports say that setting up a new account is complex, and customer service may be lacking. There is also a minimum balance of $10,000, which may not be feasible for anyone starting out with self-directed investing.

Best stocks to buy in 2022

You could buy your stock shares from the top Canadian companies such as Pollard Banknote (makers of instant lottery tickets), Shopify, Telus, TFI International (trucking and logistics), Parklands Fuels, Goeasy Limited (non-prime leasing and lending), Algonquin Power and Utilities, Canadian Natural Resources (oil), Nuvei, and Royal Bank of Canada.

Alternatively, you may decide to invest in the best Canadian ETFs.

Top 10 Canadians EFTs

An ETF is a pooled investment security that operates almost like a mutual fund. Just like you can buy regular stocks in a stock exchange market, you can also purchase and sell ETFs from the stock exchange market.

An ETF can contain all types of investment, including bonds, stocks, and commodities. Buying ETFs offers you a lower expense ratio and fewer commissions from the brokers than buying individual stocks.

Additionally, buying ETFs is associated with low risk since they are more affordable and hold a basket of securities, diversifying your investment. ETFs also have lower expense ratios than mutual funds. In Canada, there are many options for investing in ETFs, and here is the best ETF in Canada list.

The right ETF will depend on your risk tolerance, your objectives for the investment, and the amount of money you are willing to invest. There are over 1,000 listed ETFs in Canada, and it can be hard to choose the best ETFs for your investment.

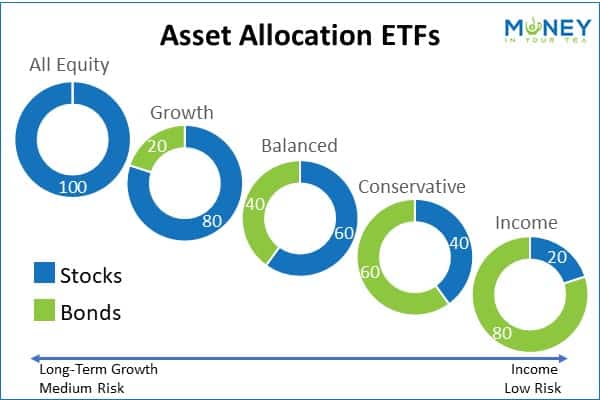

Beginning investors may prefer asset allocation ETFs, which combine a basket of stocks and bonds perfect for your own level of risk tolerance.

Here is a list of the best ETFs in Canada.

Vanguard Growth ETF Portfolio (VGRO)

Since its inception in 2018, VGRO has grown to become one of the best ETFs in Canada. Compared to mutual funds, VGRO has a low-cost management fee, and this can lead to increased returns over time. Its tax efficiency is top-notch, and it offers hassle-free management because it requires no manual rebalancing.

Vanguard Balanced ETF Portfolio (VBAL)

Like VGRO, VBAL does not require frequent rebalancing making your management easy. It also comes with lower management fees compared to mutual funds, and the portfolio is not too risky, reducing your risk of losing your money.

Vanguard ALL-Equity ETF Portfolio (VEQT)

If you are looking to tie up your ETF investment in stocks, one of the best options is VEQT. By investing in VEQT, you get international exposure to over 50 international markets instant diversification, and you will not need to rebalance frequently. But compared to VBAL and VGRO, VEQT is more volatile, so your risk tolerance should be way above average to feel comfortable with this option.

BMO Aggregate Bond Index ETF (ZAG)

BMO Aggregate Bond Index ETF offers broad diversification and lower cost compared to similar ETFs such as some of the Vanguard bond ETFs.

iShares Core Balanced ETF Portfolio (XBAL)

With a market capitalization of over $700 million, this ETF is one of the best in 2022. As an investor, you are provided with exposure to real estate allocations, fixed income securities, and equity. It is an excellent option if you are looking for long-term capital growth.

Vanguard FTSE Emerging Markets All Cap Index ETF (VWO)

Vanguard FTSE Emerging Markets All Cap Index ETF is a popular choice if you are looking to focus on emerging markets. Like other Vanguard options, it has among the lowest expense ratios and it is diversified across thousands of companies.

iShares XIC ETF

Like many iShares exchange traded funds, XIC is a low-cost ETF. It is an excellent option if you are looking for a long-term core investment. Note that it invests entirely in Canadian equity securities, which could be an issue for someone looking for more diversity.

iShares Core S&P US Total Market Index ETF (XUU)

If you are looking to own the U.S. stock market while still in Canada, you should consider XUU. It comes at a low cost, and it has a medium risk.

iShares Core MSCI All Country World ex Canada Index ETF (XAW)

You could also pair iShares Canadian ETF with this all-country-excluding-Canada ETF. This would give you exposure to financial markets across the globe, while still investing in Canadian dollars. It holds shares in over 9,000 companies, giving you excellent diversification.

Vanguard FTSE Canada All Cap Index ETF (VCN)

VCN makes it easy for investors to access multiple securities and diversified portfolios at an affordable price. It is worth noting that VCN returns are volatile and affected by the changes in the financial markets.

Final Thoughts

Investing in Canada still makes a lot of sense, even in 2022. The stock market is always volatile. But over the long term, it’s a reliable way to protect your investments from inflation.

ETFs have low management fees and diversified risks. And they are particularly easy for beginner investors.

Discount DIY brokerages Questrade and Qtrade are both great choices for Canadians.

Be sure to conduct your own research and choose the options that suit you best.