If you’re in a position where you have enough money to invest the maximum in both your RRSP and your TFSA, that’s amazing. But for most of us, we have to make the choice between one or the other – or a bit of both. Both are government plans that let you grow your money tax-free. The TFSA has more flexibility for withdrawals, but it has lower contribution room. The RRSP has higher contribution room if you have earned income and provides a tax deduction, but tighter restrictions on withdrawals.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

RRSP vs TFSA Comparison

Let’s look at a comparison between the Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA).

There are a lot of similarities, for instance, in both types of accounts you can have a savings account or GIC if you want zero risk, or you can invest in stocks, bonds, mutual funds, ETFs, and more. In both accounts, your money grows tax-free.

However, there are some key differences. RRSPs are great for saving for retirement, and also a possibility for saving for your education or first home. TFSAs are great for those too, but also for any other savings goals, as you can take your money out without paying income tax on it.

Setting Up a TFSA or RRSP

A Registered Retirement Saving Plan is an obvious choice for putting money aside for your senior years. The Tax-Free Savings Account can also be used for retirement savings, and so much more.

| RRSP | TFSA | |

|---|---|---|

| Intended Purpose | Save for retirement | Any savings goal |

| Investment Options | Savings account, GICs, bonds, stocks, mutual funds, ETFs, and more | Savings account, GICs, bonds, stocks, mutual funds, ETFs, and more |

| Income Types | You can earn income from interest, capital gains, or dividends | You can earn income from interest, capital gains, or dividends |

| Spousal Plan | You can set up and contribute to a spousal RRSP; good if one spouse has much higher earned income than the other | You cannot set up a spousal TFSA, but you can give your spouse money for them to invest in their own TFSA |

| Child Plan | You cannot open an RRSP for a child; a Registered Education Savings Plan (RESP) is the way to save for them | You cannot open a TFSA for a child; a Registered Education Savings Plan (RESP) is the way to save for them |

| Starting Age | You can open an account at age 18 | You can open an account at age 18 |

| Expiration | RRSPs must be converted to Registered Retirement Income Funds (RRIFs) by age 71 | No expiry age |

Contributions: RRSP vs TFSA

The government doesn’t allow you to contribute as much as you’d like and avoid all income taxes. That would hardly be fair! Here’s what you need to know about contributions to your plan.

| RRSP | TFSA | |

|---|---|---|

| Contribution Limits | Up to 18% of previous year’s earned income, to a maximum of $27,230 in 2020 | Maximum $6,000 in 2020 |

| Pensions at Work | If your employment includes a pension plan, you will have less RRSP contribution room | Employment pensions do not affect TFSA contribution room |

| Over Contribution Penalty | You can over contribute up to $2,000 without penalty (but cannot claim it for taxes), above that the penalty is 1% per month on the excess contribution | Penalty of 1% per month on the excess contribution |

| Catch-up Contributions | Unused contribution room carries forward from previous years | Unused contribution room carries forward from previous years |

| Income Tax Deduction for Contributions | You can claim an income tax deduction in the year you make a contribution, or carry it forward to future years | No income tax deduction |

| Low or No Income | Contribution room is generated by your earned income; if you have not worked in Canada (e.g., immigrant, student, stay-at-home-parent) this may not be right for you | Contribution room is generated by your age, not income, making this a better choice for those with low earned income |

Withdrawals and Taxation

Withdrawing funds from your RRSP can affect your income tax owing that year and also your government benefits such as Old Age Security (OAS). TFSA withdrawals do not.

| RRSP | TFSA | |

|---|---|---|

| Withdrawal Costs | Unless withdrawing under a specific plan (such as the Home Buyers Plan or Lifelong Learning Plan) a withholding tax will be levied for income tax for that year | No penalties or taxes for withdrawing your funds |

| Are Withdrawals Considered Income | Withdrawals are treated as income for taxation and calculating government benefits such as Old Age Pension | Withdrawals are not counted as income, and do not incur income tax or affect government benefits |

| Repaying Withdrawals back into the Plan | Withdrawals under the Home Buyers Plan or Lifelong Learning Plan must be repaid; otherwise you cannot recontribute funds that have been withdrawn | You can recontribute any funds withdrawn, starting in the next calendar year |

| Taxation on Growth in the Account | Interest, dividends, capital gains, etc. grow tax-free within the plan | Interest, dividends, capital gains, etc. grow tax-free within the plan |

| Capital Losses | If your investments go down in value, you cannot claim the capital loss on your income taxes as a deduction | If your investments go down in value, you cannot claim the capital loss on your income taxes as a deduction |

| Taxation on Withdrawals | Withdrawals are taxed at your marginal income tax rate at that time | Withdrawals are tax-free |

Marginal Tax Rates and Tax Brackets for RRSP Contributions

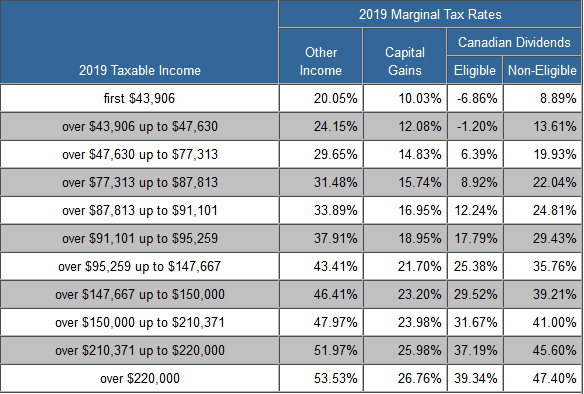

The image below from TaxTips.ca shows the combined federal and Ontario 2019 marginal tax rates and at what income you move up to the next level. Each province and territory sets their own marginal tax rates and brackets.

The table may look a bit complicated, but the gist is that the more income you make, the higher your tax on that last dollar of income.

An RRSP contribution generates a tax deduction. If you earn $110,000 in income, a $10,000 RRSP contribution would generate a tax refund of $4,341 in federal and Ontario taxes! This is because the marginal tax rate for someone earning $95,259 to $147,667 is 43.41%.

The same $10,000 RRSP contribution for someone earning $40,000 would only generate a tax refund of $2,005. The marginal tax rate for someone earning less than $43,906 is 20.05%.

Source: TaxTips.ca

Conversely, when you withdraw funds from your RRSP, you will face withholding taxes immediately that will be applied against any income taxes owing that year.

Imagine in retirement you earn $55,000 and withdraw $10,000 from your RRSP. You will owe federal and Ontario taxes of $2,965. The marginal tax rate is 29.65%. When you contributed years ago, if you got a tax refund of $4,341, you come out ahead! If you got the refund of $2,005, this has not gone well for you. The exact figures vary by province, but the idea is the same.

You can see that the benefits of the income tax deduction from RRSP contributions is really for those who are earning higher now, and expect to earn less in retirement when they are withdrawing those funds.

How do Tax Rates Affect TFSAs?

Short answer: they don’t. The TFSA program is much simpler. You’ve already paid taxes, you contribute to your TFSA out of what’s left. Everything grows tax-free and withdrawals are tax-free. Withdrawals are not counted as income, and don’t affect your income taxes or government benefits.

Where Should you Set up your RRSP or TFSA?

My favourite company for RRSP and TFSA investing is Questrade. Questrade Self-Directed Investing offers free ETF purchases, so it’s easy to see why they are so popular. There are no account opening or closing fees. And no annual RRSP or TFSA account fees. You can invest in stocks, bonds, mutual funds, ETFs, options, precious metals, and GICs.

Not comfortable yet with DIY investing? No problem! Managed investing with Questwealth is still a great deal! They’ll ask you a few simple questions about yourself and your financial goals, then recommend a customized portfolio based on your responses. When life changes – you buy a home, have a baby – let Questwealth know and they’ll adjust your portfolio to suit your new circumstances. Best of all, your dividends are automatically reinvested so they start growing right away.

I’ve written more about Questrade in my Personal Finance Deals for Canadians page, if you want more details about why I love them so much.

What Savings or Investments Should you Pick?

If you save with a savings account or GIC (guaranteed investment certificate), your interest rate and your funds are guaranteed. You know with 100% certainty exactly how much money you will have in the future. The problem is, interest rates are not very high, and with 2% inflation your purchasing power can actually decrease over time.

For long-term goals, it’s very important to invest in a mix of stocks and bonds, in order to get a higher long-term return on your investment. The typical expected return on stocks is about 7% per year. But as we all know, sometimes the stock market goes way up, and sometimes it falls for a while. Picking individual stocks is at best a shot in the dark. The approach I always recommend is to invest in an index ETF (exchange traded fund), which is like a basket of hundreds of stocks all in one. If the value of one stock goes down, but the others go up, overall you’re still okay.

Saving in a savings account or GIC is generally the right choice when your goal is less than 3-5 years away. For instance, if you’re saving for a downpayment on a house.

Investing in stock market ETFs is ideal when you’re saving long-term, such as for retirement. Yes, the stock market will probably drop sometime before you retire, but it always seems to go back up again and even higher than before.

Both RRSPs and TFSAs have the word “Savings” in their name. But don’t be fooled. You can open investment accounts for both plans. Within an RRSP or TFSA, you can have a savings account, GICs, stocks, bonds, ETFs, mutual funds, and more.

Still Can’t Decide? Take my Quiz!

Get ready to count up your score! You can write tally marks on scratch paper under the heading RRSP vs TFSA, or literally use your fingers to keep track! There are only 10 questions, so here we go!

- I’m saving for short-term goals such as education or buying my first home: An RRSP allows withdrawals under the First-Time Home Buyers Plan and Lifelong Learning Plan, but there are restrictions; a TFSA has no withdrawal restrictions.

- I’m saving for other short-term goals, such as a vacation, wedding, new baby, new car, bigger house, etc.: A TFSA is likely best because withdrawals are tax-free.

- My biggest goal is to save for retirement: Both the RRSP and TFSA are great choices for retirement savings.

- I’m saving for an emergency fund: You’ll want to access this account without facing withdrawal penalties, so a TFSA is a better choice, but you may also prefer a simple high-interest savings account (HISA) and leave your TFSA for investing to take better advantage of that income-tax-free growth.

- I have a low income now, but expect to earn more in the future: You won’t benefit much from the RRSP income tax deduction if you’re in a low marginal tax bracket, so a TFSA is likely the better choice for now. You can always move funds from a TFSA to an RRSP later, as your income rises and get the income tax deduction then.

- I have a high income now, but expect it to fall in retirement: You’ll probably want that big income tax deduction from investing in an RRSP.

- My income is less than about $50,000 now and I expect to be the same or lower in retirement: In retirement, RRSP withdrawals might claw back some of your government benefits such as Old Age Security (OAS). If you invest in a TFSA, the withdrawals in retirement will not be counted as income, protecting your government benefits.

- I get a great pension through work: If you have a work pension, your RRSP contribution room is reduced. Moreover, if you have a high income in retirement, your may lose some or all of your Old Age Security (OAS). If you expect your pension to be high, consider investing in a TFSA to keep your taxable income in retirement lower.

- My employer has a company match for RRSPs: This might tips the scales towards RRSP investing for your retirement. Free money is free money! You need a pretty strong reason to turn it down.

- I’m likely to spend any money that I can access easily: If money burns a hole in your pocket, you might prefer the RRSP since the withholding tax on withdrawals is a big motivator to leave it alone.

RRSP vs TFSA: Final Thoughts

If you’ve read up to this point, taken my quiz, and you STILL can’t decide, I have one last suggestion for you. Contribute your funds to your RRSP, and take the tax refund and invest it in your TFSA.

Please note that the information here and elsewhere on my blog is for education and entertainment purposes only. Any examples are for demonstration purposes and may not apply to your personal situation.

Pingback: Weekend Reading – Bumble billionaires, best brokerages, RRSP vs. TFSA debates, retirement and more! - My Own Advisor

Hey Kari,

Great post, thanks for putting it together. I love the side by side comparison. The only thing I would add is regarding withholding tax on USD stocks within a TFSA. Because the U.S. does not recognize the TFSA, dividends from USD stocks are taxed. Most people don’t know this. On the other hand, there is no withholding tax on USD dividends in an RRSP. Because of this, I hold my Canadian stocks in a TFSA and my USD in an RRSP.

Thanks for adding this important point! I’m more of an ETF investor rather than individual stocks, so this wasn’t really on my radar. It also leads to the idea that you need to optimize your investments across ALL your buckets, not necessarily within each bucket, depending on the purpose of those funds.