Global stock markets in early 2020 experienced a significant downturn. What should you do in a stock market crash? Intellectually, we know that the worst thing to do is to panic and make emotional decisions. But it’s hard to stay the course when you open your online investment account and see everything is in the red!

Keep reading for my 7-step plan to ride out a stock market crash. Including 4 tips for ways to make money during a downturn!

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

For all my articles on this theme, go to Personal Finance during the Coronavirus Pandemic.

Global Stock Market Declines in the News

With headlines like these, it’s hard not to feel worried for your investments.

Just look at the grim faces in those news headlines! And not only are we looking at a stock market crash, the blame is put on the global coronavirus (also known as COVID-19) pandemic.

1. Be Prepared Ahead of a Market Crash by Investing for your Needs

Stock markets go up, and they go down. That’s the nature of investing in equity. So you need to be prepared for this by investing based on your needs.

What does that mean, exactly, to invest based on your needs?

Money that you Need in the Next Five Years

Based on my experience and the recommendations of many other, I believe that that any money that you need within the next 12 months should not be invested in equity. For instance, one of my children is starting post-secondary school in 6 months. His education fund is almost 100% in GICs right now. Did he lose out on some potential gains by not being in equity in the bull run of 2019? Sure he did. But it was more important to protect the money he already had from losses.

Money that I will need in the 1-5 year time frame, I would also invest more cautiously. The longer my time horizon, the more confident I am that any stock market crash or correction will be reversed before I need that money. As a result, I would be investing in equity for greater income and growth.

Going back to education funds, my youngest is still in elementary school. Her education fund is about 65% equity. She has such a long time until she needs that money, I am confident any investment losses she experiences now will be regained.

Arguably, I could invest her education fund even more aggressively in stocks, but it’s important to recognize your own risk tolerance when you’re making these decisions.

Here’s a deeper look at how I adjust investments in my children’s education funds as they grow from babies to high school students.

Retirement Investing Rule: 100 Minus your Age

Traditional advice for investing in your retirement fund was that you subtract your age from 100, and that’s the amount you invest in stocks. The remaining would be in fixed income, such as bonds, GICs, cash, etc.

Following this guideline, a 30 year old could invest 70% in a stock market index ETF fund, and 30% in a bond ETF fund.

This is now commonly seen to be too conservative, and this rule has often been adjusted to the following.

Retirement Investing Rule: 120 Minus your Age

Similar to above, but now you subtract your age from 120. A 30 year old would now invest (120 – 30 = 90) 90% of her portfolio in a stock market index ETF fund, and only 10% in a bond ETF fund.

A recent article from MoneySense.ca discusses both of these asset allocation rules, but also points out that how much you contribute to your retirement account is ultimately much more important than your percent in equities versus fixed income. This is so important, I’m going to say it again. How much you invest is ultimately much more important than your allocation between stocks, bonds, and other investments.

More important than rules, is your own tolerance for risk. If a large decline in the value of your retirement fund would keep you wake at night, then consider having less invested in equity regardless of what the rules of thumb say.

How are YOUR Investments Allocated?

In a past article, I wrote about how James asked “Will there be a stock market crash in 2020?” He was concerned because of a long bull run in the market, but he also didn’t want to pull out of investing too soon and miss out on potential gains. My short advice to him was that if he is investing for retirement, he should go more risky. If he’s saving up to buy a house, he should not. He said he was doing both.

Thinking about your own financial planning goals, do you know how your investments are allocated? Pick up a copy of my investment planner worksheet to help you make investing decisions that are right for your own needs.

2. Remember, this is Why you have Bonds and Cash

History has shown that investing in stocks over the long term will give you big gains that you need to beat inflation. In the long run. In the short run, sometimes equity goes down, and it can take a while to recoup those losses.

But you probably aren’t invested 100% in equities, are you. The other big component of your investments is likely bonds. Do bonds go up when stock markets go down? Sometimes.

What has happened in bond markets at the end of February 2020? Let’s take the Vanguard Intermediate-Term Corporate Bond Index Fund ETF Shares (VCIT) as an example. It began Monday, February 24th at $93.63 per share. And it ended the week on Friday, February 28th at $94.15 per share. It went up in value! Let me repeat that. While all our stocks were dropping like stones, this bond index went up. It went up by only 0.5% – that’s ½ of 1%, so not very much. Now not all bond indices went up that week, some dropped a bit, but generally the gains and losses in bonds are substantially less than in equity.

Let’s say you have $6,000 of your investments in equity that just dropped 10% this week. The other $4,000 of your investments are in bonds that stayed the same. Your $6,000 is now worth $5,400, and your $4,000 in bonds is still worth $4,000. In total, you started with $10,000 and now have $9,400. So you definitely lost money. But your total portfolio only went down by 6%. Not 10%.

What Investment is Safe in a Stock Market Crash?

What goes up when stock markets go down? Sometimes bonds. GICs (Canada) and CDs (US) always go up in value. Your investment in these are guaranteed. They will continue earning interest at the amount stated when you bought it. People sometimes ask are bonds safe during a stock market crash. They are not safe in a guaranteed sense, but they do tend to buffer stocks. Cash is truly safe, in GICs/CDs or high interest savings accounts.

So remember that your bonds, as well as cash holdings like GICs (in Canada) or CDs (US) are doing their job right now.

3. Be Calm and Think Long-Term

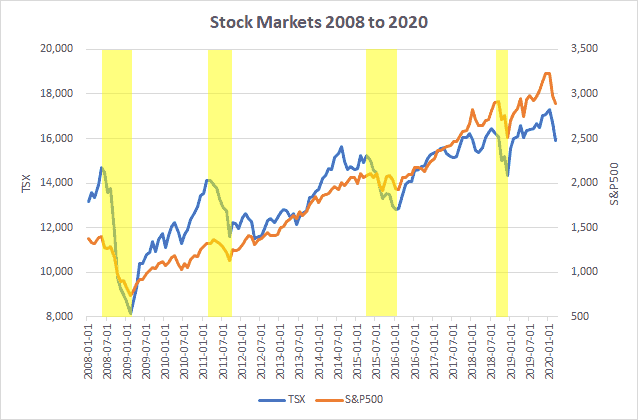

If you have invested for your goals, then you can sit back and ride it out, without getting too worried about the current market downturn. Check out this stock market graph from 2008 to 2020.

We’ve experienced several stock market downturns since the big financial crisis of 2008. I’ve highlighted these in yellow. But looks what happened in between the crashes. Long periods of rising stock prices.

And more importantly, what is the long-term stock market trend? Up! The last 10+ years have seen incredible gains in the stock market. So your retirement investment account went down this week? As long as you aren’t retiring in the next couple of years, so what. I am quite confident that looking back from another 10 years, 20 years, 30 years, or more in the future, this will be just another blip.

4. Stocks are on Sale, Pick up some Bargains!

If you were planning on investing more money soon, this could be a great opportunity to pick up some bargains! In mid-February you might have paid $50 for your stock of choice, and now it’s on sale for $40 each! That means with a $1,000 investment, you would have been able to buy only 20 shares – but now you get 25 for the same total cost! Take this opportunity to buy more shares at a lower price.

If you don’t have extra money to invest, look at your asset allocation. That is, the percent you have invested in stocks versus bonds. Maybe you’d like to sell some bonds, which haven’t lost much in value (or may even have gone up a little!). And then buy some equity with those funds.

Consider your own personal risk aversion, and take a look at the rules of thumb for short-term and long-term investing that I discussed above.

5. In Non-Registered Accounts, Consider Tax-Loss Harvesting

Another way to take advantage of a stock market crash is tax-loss harvesting.

If you were considering selling some stocks in your non-registered accounts anyways, this may be the time to pull that trigger. Collect those losses to offset other capital gains, and pay less income taxes.

6. Set up a DRIP

If you haven’t already set up a Dividend Re-Investment Plan (or DRIP for short), this could be a great time to do so. What is a DRIP? When your dividends get paid out every month or every quarter, they automatically get reinvested into the same stock. That is, if you own Widget.co, and they pay you a dividend of $50, that used to just accumulate in your account and earn nothing. But in a DRIP, if the stock price is $10, it gets reinvested into buying you 5 more shares in that company! It’s a great long-term strategy to build your investment holdings. And there’s no trading fee for reinvesting this way.

While stock prices are down, these dividend reinvestments will get you more bang for your buck. When Widget.co’s price goes back up to $12 per share, your $50 dividend will only buy 4 new shares. Take advantage of the stock market downturn by setting up your DRIP today.

How do you set it up? Depending on your brokerage company, you may be able to do it online through your account. Or you may have to phone in and have them set it up for you. I have always found the support at my brokerage to be very helpful and fast.

7. Your Total Net Worth isn’t Just Investing

Your total net worth is calculated as the value of everything you own, then subtract everything you owe. For example, if you own a house worth $500,000 and you have a mortgage of $200,000, then you would have $300,000 of equity in your home.

Your cars also have value, although the value declines each year.

If you have rental properties or other items of great value, they would also add to your net worth.

Yes, your investments may have fallen due to a stock market correction. But the value of your other assets haven’t. So the total impact on your net worth is smaller than the 10% decrease in your equity.

Final Thoughts

Fear can cloud your judgment. Remaining calm during a stock market crash can take tremendous effort and self-awareness. Successful investing means you want to buy low and sell high – not the other way around. Selling stocks in a panic is the worst thing you could do right now.

The best thing to do right now may be nothing. Take a deep breath, turn off the TV, ignore the news, and don’t log in to your investment accounts at all. Stock markets always have gone up again in the long run, and there’s no reason to think this will be any different.

If you are determined to make money during a stock market crash, consider the following:

- Investing more money in equity while the prices are lower;

- Reallocating from bonds and cash into equity, if your risk tolerance and time horizon allows;

- Harvesting some losses to offset capital gains from other investments for income tax purposes;

- Setting up a Dividend Reinvestment Plan (DRIP).

Remember that you invested with a plan. Stick to your plan, and time will see you through any stock market downturn.

This is such a comprehensive article, Kari. I think you’re doing a great service to your readers by being another calm, rational voice. We all need more of that during turbulent times like these.

I especially agree with you on #4—stocks are on sale! This is the buying opportunity that so many of us have been waiting for. 🙂 I’m excited to invest some of our cash in the markets soon!

Very timely article, Kari! I think your points are very wise. I like your points on the investment time frame, thinking long term, stock bargains, and DRIP. Like you said, the key is to prepare in advance and to not panic. Thanks for sharing!