I groggily answered the ringing phone at 6am, and was alarmed to hear an official-sounding robotic voice. “This is the alert system with Visa (or Mastercard) account services!” It went on to tell me that there were two suspicious charges to my Visa card. It went on to describe the charges, which were in the hundreds of dollars. Press 1 to accept these charges, press 2 to reject them and be connected to a customer service representative. Find out what to do instead, so you don’t fall prey to this new credit card scam.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

Key Takeaways:

- Be suspicious if you get an automated call from Visa about charges, especially if it is outside of regular bank business hours.

- Do NOT press 1 or 2 or anything else – hang up instead.

- Do NOT call the phone number they give you to verify the legitimacy.

- If you are unsure whether the call is legitimate, phone the Visa or Mastercard number on the back of your credit card.

Protect yourself and your loved ones from becoming the next victim of the very latest text fraud! SCAM: Mom I’ve dropped my phone in the toilet!

Keep reading for more details about this Visa scam phone call. Prevent falling for this and other common fraud calls. And the essential steps you must take if you think you might be a victim of fraud.

How this Visa Scam Call Works

- They time their calls for the early hours of the morning. My call was about 6am. Others report having calls anywhere between 5am and 7:30. The hope of the scammers is that because you are groggy and half asleep, your guard will be down. That can make you more vulnerable to fall for their scam.

- The automated call from Visa about charges sounds official – “this is an important message regarding your credit card account”. It sounds exactly like when you call the bank and get their robotic system before connecting to a human. This was high quality!

- The call states that unauthorized charges have already been made to your credit card account. (This is a lie! No charges have been made to your credit card.) The automated voice describes the charges, including the amount, which is in the hundreds of dollars. The fraudulent charges are high enough to be alarming.

- The call then gives you the choice to accept the charges by pressing 1, or preventing the charges, by pressing 2. Naturally they expect people will press 2, because these charges don’t exist!

- At that point, you are connected to a person, who will “help” you. This is where they start phishing for information. In my case, I hung up because I was exhausted, and I’d already declared the charges were not valid. I did not yet realize I was being scammed, but I decided to phone back later in the day.

- Reports describe how the fake credit card representative will then ask you which bank your credit card is for. They then ask you if the card starts with the following 4 numbers. Yes it does! That’s because all credit cards from that bank start with those four digits!

- Now that you’re comfortable that the bank is “legit”, they ask you for the remaining digits in your credit card, to confirm with their system. THIS IS YOU GIVING THE SCAMMERS YOUR CREDIT CARD NUMBER! Presumably they then ask you to give them the expiry date and possibly the PIN on the back of the card.

- The credit card scammers now have all the information they need to place fraudulent charges on your credit card.

How this Scam can get Worse!

There are a few different ways this credit card scam can get worse, according to a recent article from Greedyrates.

Call-Back Request: The scammers may ask you to hang up and call the bank’s 1-800 number on the back of your credit card to prove the call is legitimate. However, they don’t hang up the phone, and instead play a dial tone sound. So you think you’re calling the bank, but you get the same scammer when they “answer”. At this point, they may ask you to transfer your funds to a “safe” account while they investigate. Now they have your bank account funds AND your credit card number!

Transaction Review Request: The “investigator” asks you to give remote access of your computer to them so they can “review suspicious transactions”. Now they have access to anything on your computer, including your online banking, AND your credit card number!

Bank Investigator: The scammer asks you to “help” them catch the criminal, sometimes described as a dishonest employee, by accepting a deposit and then transferring it back to them. The deposit, however, is fake, so you end up transferring your own funds to them. Now they have your bank account funds AND your credit card number!

Components of a Credit Card Number

This section is just for those who are interested in diving into the rabbit hole of learning about credit card numbers. If you’re not that interested, feel free to skip ahead to the next section!

The first digit of your credit card number is the Major Industry Identifier (MII). For example, an MII of 4 indicates a Visa card. AMEX starts with 3, Mastercard starts with 5, Discover Card starts with 6.

Digits 1-6 are called the Issuer Identification Number (IIN) or Bank Identification Number (BIN). It indicates the bank that issues the card, whether it’s a business or personal card, what region or country it was issued in, etc. For example, 4520-34 indicate this is a TD Canada Trust Visa card, issued in Canada. For banks with more than one IIN, cards of the same type and same region will generally have the same IIN. (See more at Credit Card Validator and Credit Card Review.)

Digits 7-15 are your Primary Account Number (PAN), and are unique to your account.

Digit 16 is the last number on most credit cards. This is the check digit, that allows for easy verification of the number. It helps to detect typos, or transposing digits. That is, entering “1324” instead of “1234” for part of your credit card number. If you want to go down an even deeper rabbit hole, you can read more about the Luhn Algorithm for credit card validation.

The credit card scam people know the IINs for all the banks. They say they’re calling about a Visa card, and then you confirm that you do have a TD Canada Trust Visa. So when they say, “I’m confirming that your card starts with 4520”, you will confirm that it is, in fact, your card.

How Long has this Credit Card Scam been Around?

A July 2020 article from Greedyrates reports “RCMP Warns of New Credit Card Scam”

However, I found a report from the CBC in January 2015 in an article called “New credit card phishing scam hits Canada”. In the article, a call-taker from the anti-fraud department states that this phishing scam has been “quite successful”.

While it may have been around for a few years, this is the first I have heard of it. It certainly seems less common than the Canada Revenue Agency scam, which I get weekly. Or people wanting to clean my air ducts – we don’t even have air ducts, as our old house has hot water radiator heating.

Is Fraud a Big Problem in Canada?

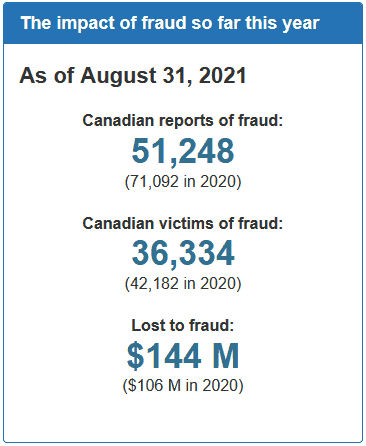

The best source of information on this is the Government of Canada’s Anti-Fraud Centre.

In the first 8 months of 2021, over 50,000 Canadians reported fraud attempts. There were more than 36,000 victims of fraud, who lost more than $140 million! That works out to an average loss of almost $4,000 per victim.

And the situation is worsening. In 2019, nearly 20,000 Canadians lost over $102 million. In 2020, over 42,000 Canadians were victims of fraud, and lost a total of $106 million. At only 8 months into 2021, Canadians have lost over $140 million to fraud!

Clearly fraud is a profitable business for the crooks. And victims are losing substantial amounts of money, which can be life changing.

How does Visa Notify you of Suspicious Activity?

This is the tricky part of this phone call scam. Because Visa will legitimately call you if they detect suspicious charges on your account.

However, remember that the real Visa already has your account information. They know your name, credit card number, expiry date, and the 3-digit code on the back. They will never ask you to tell them this information.

How to Prevent Becoming a Victim of Credit Card Scams or Other Fraud

There are many things you can do to prevent becoming a victim of fraud:

- Don’t be afraid to say “NO”, or to hang up on a call

- Do your research, verify the organisation is legitimate

- Be wary of plays on your emotion – “Gran, it’s me! I’ve been in an accident and I need money quickly!”

- Don’t give out personal information, especially on unsolicited calls

- Don’t carry unnecessary ID or credit cards in your purse or wallet – this minimizes how much a thief can steal

- Never leave your purse or wallet unattended in a public place (including work, shopping carts, parties, restaurants, and church); never leave your purse or wallet in view in your car, even if it’s locked

- Use a shredder to destroy mail with personal information such as your credit card statements, including pre-approved credit card offers that you do not want

- Be wary of upfront fees – there are NO prize fees or taxes in Canada

- Protect your computer: watch out for spoofed emails; be careful when clicking on attachments or links; never click on urgent-looking messages that pop up while you’re browsing online; never give strangers remote access to your computer

- Be careful who you share images with; disconnect or cover your webcam when you are not using it (hackers can get remote access and record you)

- Know who you’re dealing with

- Watch for anomalies in your finances or credit score and report immediately

- For businesses, limit your employees’ authority by only allowing a small number of staff to approve purchases and pay bills

If you don’t already track your credit score, you can do that for free with Borrowell! Your credit report can alert you to any fraud or identity theft if someone takes out a loan or a credit card in your name.

Sources: TransUnion, The Canadian Anti-Fraud Centre

What to do if you Think you are a Victim of Fraud

Please know that you are not alone. Remember that there were over 42,000 victims of fraud in Canada in 2020, and it looks like we’re on track for even more in 2021.

Fraud can go unreported because victims are embarrassed. By reporting the fraud you are helping the authorities to catch the perpetrators. And you can prevent someone else from becoming a victim.

The most important first step is to remain calm. Of course it’s natural to be upset! But a clear head right now is important.

Start with gathering any evidence: documents, receipts, bank statements, copies of emails or text messages if applicable.

Next, contact your financial institutions. The phone numbers are on the back of your credit and debit cards, and your bank statements. Ask them to place flags on all of your accounts. Then change all your banking passwords.

Report the fraud to both credit bureaus, Equifax and TransUnion.

Contact your local police. Remember that 911 is for emergencies only, but there will be a local phone number you can call. Also report the fraud to the Canadian Anti-Fraud Centre toll free at 1-888-495-8501 or through the Fraud Reporting System.

If your government issued ID has been stolen, contact the appropriate level of government in your province or territory:

- National government issued ID includes: passport, immigration documents, social insurance number

- Provincial government issued ID includes: driver’s licence, health card, birth certificate

Protect yourself from future fraud. Once you have been a victim, you may be targeted again. Sign up for free with Borrowell to track your credit report, which can alert you if someone tries to take out credit in your name.

Did I Become a Victim to this 6am Credit Card Scam?

The phone call woke me up at 6am. The professional-sounding automated voice said two charges had been made to my Visa. It described them, then asked me to press 1 to approve the charges or 2 to decline them. Of course I pressed 2. It then said it was transferring me to a Visa representative who would help me.

At this point, I was so tired I didn’t think I could speak to someone, and I had already indicated they should decline the charges. So I hung up.

At no point did I think this call was fraudulent!

Later in the day, I phoned the number on the back of my Visa cards. (I have business Visas at two different banks for companies I work for. We use Mastercard and Amex for our personal cards.)

The first bank rep recited the most recent purchases, which were legitimate, and did not include the items listed when I got a call from Visa this morning.

So I called the second Visa number. This rep said, “We’re getting a lot of calls about early morning credit card scams!” There were no suspicious charges on this card either.

Thankfully, I unwittingly did the right thing! I hung up on the scam call, and phoned my bank using the number on the back of the card.

I did NOT become the next victim of a credit card scam.

2021 update: I have received the same scam phone call several more times. These calls from the Visa Mastercard alert system seem to be more prevalent than ever.

Just wanted to let people know that I too received a call at around 11:45 AM stating almost the identical phrase that “This is the alert system with Visa (or Mastercard) account services!” followed by stating that there were two suspicious transactions of various amounts on my credit card. Curious as I may be, I just “listened” to the robotic recording but did not press “1” or “2” or even “0”. I just hung up, went to my legitimate financial institution’s website, logged in and found no such transactions. I then called the credit department, reported the incident and gave them the number the call came from and even though they told me that the telephone number they called me from was a bogus random number, I know that whatever app that is being used to change the actual telephone number location, can still be traced back to the location they are at. It just takes a little more effort on a Federal level. I pray none of you out there fall victim to any of these ridiculous scam calls. DON’T RESPOND OR PRESS ANY NUMBERS WHATSOEVER!!!!! JUST HANG UP!!!!!

Pingback: Visa Fraud Gift Card - Visa Credit Card Security & Fraud Protection

I have a very simple understanding of bank scams etc – Firstly your bank will never call you and ask for details, Sceondly If money is taken from your bank without your authorisation thats the bank’s problem Not yours. I dont need advise for that. Just put the phone down and ignore anyone that calls you with bank related queries.

Got the robo call this morning. Baited the scammers they termminated the call. Search revealed phone number ###-###-#### is owned/operated by ####### Ontario based in Streetsville, Ontario. (This comment has been edited to remove the phone number and business number. I believe scammers cloak their phone numbers, this the scam was not perpetuated by this company.)

Great information. I got my call at 11:45 am. The caller ID indicated Vernon, BC, not “Visa,” so I was suspicious. I hung up without responding, but then called back, using the number my phone had captured. The voicemail gave no indication that it was “Visa,” but did give me an option of leaving a callback #. I left my #, in the hope that I can waste the scammer’s time.

Pingback: Call From 866-383-7495 Saying Someone Was Applying For A Credit Card Under Your Name – ProtonMoney

Pingback: I Got A Call From Inmate Asking To Put Charges On Credit Card . Said Call Was From Onepay – ProtonMoney

I got the same credit card scam call at 2PM. I do not have a credit card in my name so I was immediately suspicious but because I have access to a credit card I wondered if the call was about that one. I pressed 2 and an individual came online. The call kept breaking up and when I told the individual this, they hung up! Right away I asked the person whose card I have access to, to check for the supposed charges. They were not there and I next checked out this website. Thank you for validating my suspicions. I will let others know about this fraud.

Thanks for this info. I just got a call for this scam myself. Like you described, it asked me to press 1 to confirm or 2 to deny, but also 0 to repeat. Although I hadn’t heard of this scam before, I was immediately suspicious when the automated voice gave no identifying info for my account, so I went to go check my recent transactions online to confirm. While doing so I pressed 0 so I could hear the charges again to compare them, but it didn’t repeat, it just hung up after a couple moments. I was then able to check my account and see that there were no unauthorized charges. Afterwards, I looked it up and found your article, confirming my suspicion that it was a new scam. Interestingly, I did not get the phone call in the early morning as you described, but at around 2pm. Anyway, glad to get more info on this so I can warn my friends and family about it.