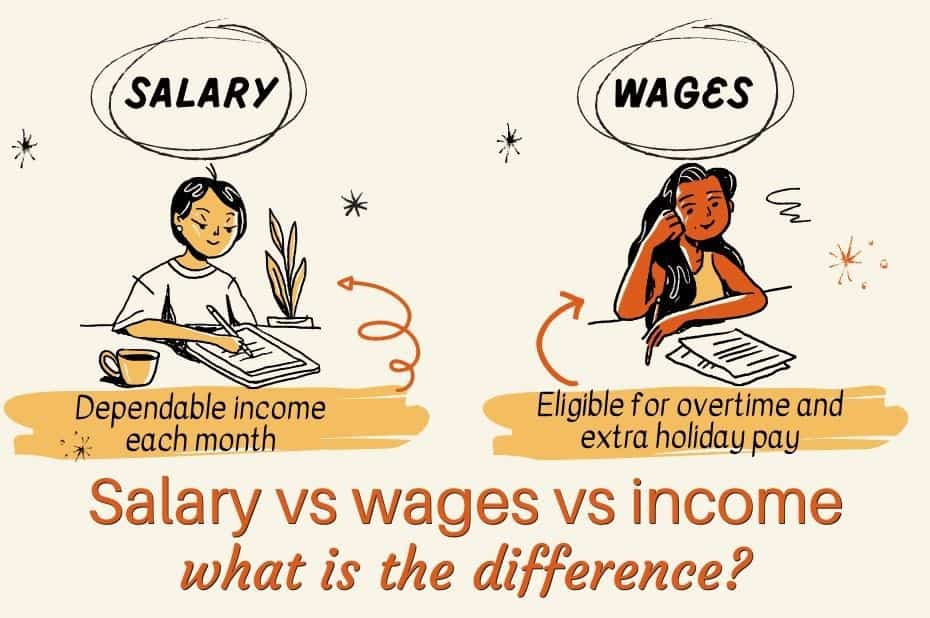

Salary, income, and wages can be confusing because sometimes people use these terms interchangeably in conversation or when trying to describe their financial situation. However, there is a distinct difference between all three of these concepts.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

Key Takeaways:

Advantages of Salary:

- Stable, dependable income each pay period

- Employee benefits, annual bonus, and/or profit-sharing

- Paid vacation days

- Typically higher paid

- Job security

- More opportunities for career advancement

Disadvantages of Salary:

- No overtime pay

- Less flexibility

- Typically skills, experience, or higher education required

- High responsibility, commitment outside of work hours

Advantages of Wages:

- Eligible for higher hourly pay for working overtime and on statutory holidays

- More flexibility for which hours you work and taking time off

- Work-life balance without needing to be accessible outside of work hours

- Easier to get a job or switch jobs

- Typically lower-skilled or no higher education required; good for students or people returning to work after a long break in employment

Disadvantages of Wages:

- Variable income; need to budget carefully

- Low job security

- Less opportunity for career advancement

- Typically lower paid, with no employee benefits, annual bonus, or paid vacations

Advantages of Income:

- Make more money; retire sooner

- Receiving income from a variety of sources makes you less financially vulnerable to a job loss

Disadvantages of Income:

- Takes significant time and effort to build up multiple sources of income

What is a Salary?

It is the amount of money an individual takes in for a specific job. Salary is a fixed payment made on a predictable schedule, such as weekly, biweekly, semi-monthly, or monthly. Salary is often expressed as the annual (yearly) total. To find your average wages per hour, take your annual salary and divide by 2,080 hours per year for a 40-hour workweek.

Salary is paid from an employer to an employee.

Deductions, such as income tax and 401k contributions, are typically removed from your gross pay just before it is received. In some cases, employers will pay for your expenses or work-related costs, including commuting or parking fees.

Salary is a set amount that you will take in each week, month, or year. Salaried employees are expected to work a set amount of hours each day or week. You typically do not get paid extra for overtime hours.

Example of Salary

Your salary is $39,000 per year. You are paid $1,500 every two weeks before taxes and other deductions from your gross income.

You work 9am to 5pm, Monday to Friday, with 3 weeks of paid vacation.

During the busy season you put in extra hours, but your paycheck stays the same. But in a good year, you get a nice bonus.

What are Wages?

Wage is the amount of money that is paid to a worker for performing a specific job.

Wages are payments based on an hourly rate and the number of hours worked during that pay period. Wage is often expressed as an hourly rate.

Employees earning wages who work more than a set amount (for example, more than 40 hours per week) get paid overtime. They also typically earn extra per hour for working on statutory holidays.

Example of Wages

Your wages are $20 per hour. Last week you worked 20 hours, you were paid $400 before taxes and deductions. This week you worked 35 hours per week and your gross pay was $700 before income taxes and other deductions.

During the busy season you worked 50 hours per week, and were paid overtime at time and half. You were paid $20 per hour for the first 40 hours, then $30 per hour for the next 10 hours. The total wages were $1,100 before taxes and deductions.

Some days you clock in at 7am and clock out at noon. Other days you clock in at 4pm and clock out at 10pm. Sometimes you might work split shifts, and don’t get paid during the 3-hour break.

You took 2 weeks of vacation but did not get paid during that time.

What is Income?

Income is the amount of money that an individual receives from all different types of sources. There are three different categories for this term: earned, unearned, and portfolio. Each class contributes to the total income. It is a broad term because it considers all forms of payment that an individual can receive.

Example of Income

You are employed and earn a salary of $30,000 per year.

In addition, you rent out a basement apartment in your house. This brings in $1,000 per month in rent, before expenses.

You also have a side hustle that earns a steady $100 per week.

Your investments pay dividends of $1,000 per quarter.

Your yearly income is $30,000 (salary) + $12,000 (rent) + $5,200 (side hustle) + $4,000 (dividends). Your total income per year is $51,200 before taxes, deductions, and expenses.

How is Salary Calculated?

Salary is determined after considering the skills required for the position and the applicants’ expertise.

Factors such as experience, overall performance, and market demand for workers with similar jobs determine the pay offered to an individual by a company.

Types of Salary:

Base Pay

Base pay is the amount of money earned per hour, week or month by a worker. Generally, your base salary is expected to increase over time with good performance and more experience.

This allows you to earn more money each year you stay at a company.

Commission

Commission is the amount of money that can be earned over and above your base pay when you achieve some sort of target.

For example, a car salesperson would receive a low base pay and a high commission for each vehicle they sell.

Bonuses

Bonuses are the amount of money that can be earned as a reward for exceeding work expectations or completing specific projects on time. In most cases, bonuses will be added to your pay and paid out once a year around holiday times.

Profit-Sharing

Profit-sharing is the amount of money that can be earned in addition to your base pay when a company has exceptionally high profits compared to its yearly budget.

The company contributes part of its profits into a pool. This fund is distributed among eligible employees, according to a formula. Typically employees with a higher salary will receive a larger amount of the profit-sharing pool.

Unlike bonuses, employees only receive profit-sharing in years where the company has been profitable.

Profit-sharing may be paid out by giving employees company shares or options.

How are Wages Calculated?

The wage of a worker is determined by the amount they are paid per hour. This will vary depending on how many hours someone works in a week.

Generally, wages are expected to increase over time with good performance and more experience. This allows you to earn more money each year you stay at a company.

Types of Wages:

Hourly Wages

Hourly wage is paid to a worker who works on an hourly basis and is generally measured in dollars per hour. This type of wage is expected to increase over time with good performance and more experience.

Tip Wages

Tip wages are supplementary income employees receive from customers, in addition to regular wages.

Overtime Wages

Overtime is paid to hourly employees who work more than full-time hours. Overtime is typically paid at time and a half.

Statutory Holiday Wages

Employees who are paid hourly wages are often in industries where they may work on statutory holidays. These employees often earn time and a half.

Types of Income:

There are many sources of income, and this is not a complete list.

Employment Income from Wages or Salary

Employment income is the total amount you are paid for working at a job.

Savings and Investment Income

Interest is the amount of money earned by an individual for investing in a savings account or bonds. This interest is usually expressed as an annual percentage and can vary depending on invested funds.

Dividends are the amount of money earned through stocks or other investments resulting from company profits.

Capital gains are earned when you sell your stocks or other property for a higher amount than you paid for them.

Rental Income

It is the amount of money earned on a long-term basis from renting out property to someone else. This can vary depending on location, how much it gets rented for and what type of property it is.

Royalty

It is the amount of money that can be earned for authoring a book, creating an invention, or performing music.

Government Benefits

Government benefit income can include employment insurance, social assistance, retirement benefits, and so on.

Pension

Pension is a type of retirement plan benefit offered to former employees, based on years of service, compensation, and age at retirement.

Self-Employment Income

Self-employment income is earned from working as a sole proprietor or independent contractor, or carrying on a trade or business. You can charge by the hour or by the task required to complete the contract. You can also earn self-employment income by selling the product you create.

Some examples include making money with your 3D printer, getting paid by writing under a pen name, renting out your home with Airbnb, or selling your finished coloring pages.

Salary vs Wages: What is the Difference?

Fixed vs Variable Income

A person receiving a salary earns the same amount each pay period. Salary is paid out on a weekly, bi-weekly, semi-monthly, or monthly basis. Many people prefer the predictability of earning a steady income that doesn’t fluctuate because their household expenses are also fixed each month.

Wages are paid out for only the number of hours worked during the pay period. During weeks where you work a lot, you will earn more money than in weeks where you work less. Some employees earning hourly wages prefer the opportunity to earn extra money during busy times of the year or by working on statutory holidays.

Experience, Skills and Education

In general, you need some combination of higher education, skills, and/or experience in order to qualify for a salaried job. Due to the higher requirements, salaried jobs tend to pay more than hourly wage jobs.

Jobs paying hourly wages are more often unskilled, and do not require post-secondary college or university education. You can start in an hourly paid position, and after gaining some on-the-job experience and skills, move up the ladder to a salaried position with more job stability and benefits.

Overtime

Most salaried employees are considered “exempt” or not eligible to receive overtime pay.

Employees who are paid hourly wages are typically considered “non-exempt”. That is, they are eligible to receive overtime pay for working over a stated full-time number of hours, such as 40 hours per week or statutory holidays. Overtime is typically paid at time-and-a-half. That is, if you typically make $20 per hour, overtime or statutory holiday work would be paid at $30 per hour.

Benefits

Employees who receive salaries are much more likely to receive benefits, such as healthcare, dental care, paid vacation, bonus, profit-sharing, pension plan or other retirement plans, and so on.

Employees who receive hourly wages are unlikely to receive benefits. Though you may get a discount for purchases you make at the company you work for.

Career Advancement

Salaried employees may have more opportunities to move up within the company into positions with more responsibility.

Hourly wages tend to be more common in lower-skilled jobs with fewer opportunities for career advancement. However, you may have the option of moving into salaried roles as your career advances. One example would be a retail checkout person becoming a department manager.

Vacations and Flexibility

Employees who receive a salary are likely to receive multiple weeks of paid vacation time each year. As you advance through your career, you tend to receive additional weeks of paid vacation. However, in some organizations there can be pressure to not take all the vacation time you are eligible for because you are “too busy” to take time off. Some employers will pay out unused vacation time, while others have a “use it or lose it” policy.

Employees earning an hourly wage do not get paid for the time they are not working. When you go on vacation, you will not be paid for those days or weeks. However, it may be easier to schedule time off, even with short notice.

You can also switch jobs fairly quickly and easily as an hourly employee if you want a change.

Responsibility and Commitment

When you work a salaried job, you may be responsible for supervising other employees, ensuring the product or service is up to high standards, or expected to contribute to growing the company. You may be expected to meet targets and deadlines. If there is work that needs to be completed, you will likely need to work additional hours without being paid extra. Your company may also expect that you can be reached at home in your time off.

If you work for hourly wages, you are not held responsible if something goes wrong that was not due to your own actions. For example, if the company does not meet its sales or growth targets. You also have an easier time separating work from home and don’t need to be reachable outside of work hours.

Job Security

Salaried workers are typically hired on a long-term employment contract. During brief periods of slow work, you keep your employment status and earn the same salary. If you are let go, you are more likely to receive a higher severance package.

Hourly workers are susceptible to having their hours cut back immediately when there is less work to be done. You may be let go entirely if the work dries up, particularly if you were hired as seasonal help. There may be little or no severance when you leave, as the wages tend to be lower and you likely have fewer years of work with the company.

Final Thoughts

The benefits of being a salaried employee include typically higher pay packages, with more opportunities for advancement, more job security, and a predictable income with paid vacations.

The benefits of earning an hourly wage include better work-life balance with more flexibility, and the opportunity to earn overtime during busy times of the year or holidays.

Regardless of where you stand on the salary vs wages debate, consider adding additional sources of income. Diversify your total income by adding rental income, investments, or other sources of income. Even if you lose your job, you will still be earning some revenue to take you through until you find the next career move.

This is a good article comparing the two. I’ve been on both and prefer salary.