The fear of running out of money in retirement is probably one of the biggest worries. For the past 40+ years, you’ve been working and stashing money away in your retirement fund. It’s great seeing that nest egg grow. But now that you’re in retirement, the money is only flowing out. Will it last? Spending time now to set up a retirement budget can help to lift that weight off your shoulders.

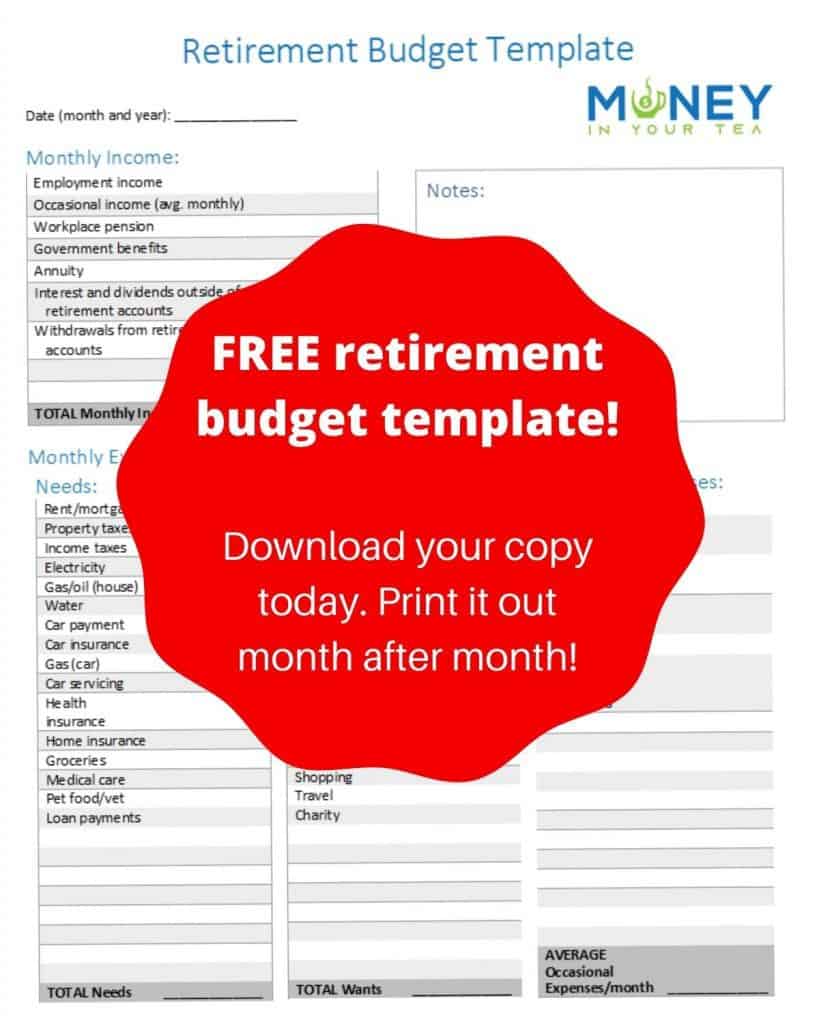

I’ve designed a FREE customizable retirement budget template, just for you! It has many of the standard spending items already filled in for you, so you can spend less time on your budgeting. Simply save the PDF file, and print it off each month! Can’t wait? Skip right to the end to download your free retirement budget template now.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

How a Retirement Budget is Different from when you were Working

There are a few key differences in your retirement budget from any budget you have done in the past.

For one, your employment income is substantially lower (if you have only partially retired) or at zero. Now you will be living off any government benefits you receive, company pensions if you’re lucky, and your nest egg of savings. After spending 40+ years saving that nest egg, it can be nerve wracking to see that balance getting smaller!

The second key difference, is that you are no longer typically adding to your retirement savings fund. In my popular article on the 50/30/20 budget rule, the final 20% of your spending goes towards paying down debt and building up saving, mainly for retirement.

Step 1: Add Up all Sources of Income

You may have several sources of income during retirement, which can be a lot to juggle. When you were working, perhaps it was just your bi-weekly paycheque and that was it.

- Traditional salary income – if you are still working part-time, or covering vacation days for your former employer, you may still be receiving a paycheque.

- Variable earned income – now that you’re at home, maybe you want to do a bit of dog sitting; write under a pen name, or do some consulting in your field.

- Pension – lucky you, if you worked in an industry with a pension.

- Annuity – you may choose to buy an annuity that pays you a fixed amount on a regular basis.

- Government benefits – in Canada these include Canadian Pension Plan and Old Age Security

- Interest and dividend income outside of your retirement fund – if you have a high-interest savings account (EQ Bank is my favourite for Canadians!) or a non-registered investment account, you may be earning income

- Withdrawals from your retirement account – this is the scary part, where you’re drawing down your nest egg and hoping it lasts.

Some of this income may come in only occasionally. Add up the annual total and divide by 12 to get your average monthly income.

Have some questions about your Old Age Security benefits? Read my article at Old Age Security: Answers to your Top 6 Questions!

I still don’t have Enough Money to Live on!

If all of the above sources of income isn’t enough for you to cover basic necessities, and you own a home, you can access the value of that property in several different ways.

- Rent out unused space in your home, such as a basement apartment. You can also write off some expenses associated with this, such as the renter’s share of utilities, on your income tax.

- Downsize by selling your home and buying a cheaper home. As well as getting a one-time large amount of cash, the cost of running a smaller home is often cheaper in terms of property taxes, utilities, etc.

- Move from a high cost-of-living city to a lower one. Even buying the equivalent style and size of house in another city (or country) can add a lot to your nest egg.

- Sell your home and rent. This will increase your monthly expenses (the rent) but you’ll have a large pot of money to draw from. Also, other expenses will be gone such as property taxes and repairs.

- Use a line of credit backed by your home (commonly called a Home Equity Line of Credit or HELOC). This can be good for covering one-time large expenses, such as needing a new roof for the house, but generally isn’t a good source of ongoing income.

- Use a reverse mortgage, which allows you to keep living in your current home. The loan typically has to be paid when you move out, sell the house, or pass away. The costs of reverse mortgages may be high, so do your homework first before choosing this option.

Step 2: Add up the Cost of all your “Needs”

Needs are the things you can’t live without, or would be life-changing to do without:

- Mortgage or rent

- Property taxes

- Income taxes – when you are retired, income tax no longer gets deducted from your paycheque, so you’ll have to pay it with your retirement income

- Utilities such as electricity and gas and water

- Transportation costs, including car payments, insurance, gas, servicing and repairs, as well as taxi/Uber, public transit, or cycling if you use any of these methods to get around

- Paying off loans, lines of credit, or credit card debt

- All types of insurance, including health, life, disability, home, etc.

- Groceries, but not any other food or drink

- Medical care such as health costs, dental, prescription glasses and vision tests, medications, and any other items such as physiotherapy

- Basic pet care costs such as food and vet

- Grooming essentials, such as regular haircuts or other things that keep you employable and nice to be around

Notice that some of the things in this list will be fixed expenses that aren’t easily changed, such as your property taxes if you are a home owner. But others may have a bit of flexibility, such as the types of groceries you buy or shopping at a discount store. Check out some great ideas to save thousands of dollars each year on your food bill.

Step 3: Add up the Cost of all your “Wants”

Wants are the fun things in life, the experiences and purchases that bring joy and memories. By retirement budgeting, we’re not cutting all the fun out of life! Wants include things such as:

- Entertainment – tickets to the big game, going to the movies, memberships, subscriptions, and so on. Netflix and cable TV both fall in this category, as they’re not “needs”

- All non-grocery food and drinks, including alcohol and bars, restaurants and take-out, the daily coffee shop latte (though making it at home falls under “need”)

- Charity – I would classify this as a “want” but if it feels like a “need” to you then feel free to put it in that category

- Gifts and parties

- Gym membership, teams and social expenses

- Manicures, spa days, etc.

- Extra pet costs, such as toys, grooming, doggy daycare

- Shopping for clothes, books, electronics, hobbies, sporting goods, and more

- Travel – calculate the average monthly cost

This is where you can have the most flexibility in your retirement budget. If part of your retirement income is dependent on stock market returns, and it has been a bad year in stocks, you can make adjustments here. You may choose to delay that big vacation for a year or two until things get better. Or perhaps cook more meals at home instead of going to restaurants.

Step 4: Calculate the Cost of Occasional Expenses

The average life expectancy is around 85. If you’re retiring at 65, that gives you 20+ years for your money to last. You’ll probably replace your car with a newer one at least twice! Here are some examples of large expenses you may face in retirement:

- Trading in your car for a new(er) model

- Replace the furnace, air conditioner, roof, or other major home repairs

- New furniture or other redecorating costs

- Replace the oven, fridge, washer, dryer, and other major appliances

- Healthcare

- Contributing to a child’s or grandchild’s wedding or tuition

- Celebrating important milestones, such as a 50th anniversary

Even if you live in Canada with a comprehensive public health care system, you should still expect to pay for some items out of pocket. Hiring someone to come in and shovel the sidewalks and driveway, mow the lawn and weed the garden, and clean the house can add up. These may be chores you can easily do yourself at age 65, but perhaps less at age 75 or 85. In your later years, perhaps you’ll need a home health care aide, or to put a lift system on the stairs to “age in place” at home. Living in a long-term care home is very expensive, too.

On the other hand, the main travel years tend to be early in retirement. By the time retirees face higher health care expenses, they may be spending less on travel and other discretionary spending.

Budgeting for One-Time or Occasional Expenses

Let’s look at an example. In 5 years from now, we plan to replace the car with a newer one. We expect the new car will cost $30,000. We’ll trade in the old one, and expect to get $6,000. The net cost will be $24,000.

Five years from now is 5 × 12, which equals 60 months.

The average monthly amount to set aside for the new car is $24,000 ÷ 60 or $400 per month.

We should set aside $400 per month for upgrading the car in 5 years.

This is obviously not an exact science. Maybe the car will need replacing in 4 years or 6 years. Maybe it’ll cost a bit more or less than we expect. Regardless, it’s better to have most of the amount set aside for this anticipated expense than nothing set aside at all.

Optimize your Withdrawals for One-Time Expenses

To be clear, I’m not a tax expert. And the key to personal finance is it’s “personal” – I don’t know your individual situation.

However, in general if you withdraw large one-time amounts from your retirement fund, you may put yourself in a higher income tax bracket. No one wants to pay more tax.

In addition, if your income is high in one year, you may risk losing some of your government benefits.

Consider withdrawing smaller amounts each year to set aside in an account for these large one-time expenses, rather than withdrawing it all at once.

In our buying a new car example above, if you withdraw an additional $24,000 from our retirement funds in one year, you can see how that might push you into a higher income tax bracket or reduce your government benefits that are based on income.

Step 5: Don’t Forget Inflation

When thinking about long-term retirement budgeting, don’t forget inflation. Both Canada and the U.S. have had inflation around 2% for an extended period, and seem likely to continue this way. And while 2% inflation is low, it’s not zero. It may surprise you to learn that even at this rate, the cost of goods will increase by about 50% between the ages of 65 and 85! That is, your $100 weekly groceries at age 65 could be $150 by age 85.

FREE Downloadable and Printable Retirement Budget Template!

This handy budget tracker comes as a printable PDF file downloadable immediately. No waiting for something to arrive in the mail, and losing your motivation. It’s got all the main needs and wants categories filled in for you, plus a few blanks to write in your own! Print off a new copy every month, and see how you’re doing!

If you’re not seeing my form to get your free budget template here, try turning off your ad blocker!

Does your Retirement Income Match your Retirement Spending?

Yes, my Income Matches my Spending!

Congratulations, your budget balances, and you can take a big sigh of relief. Enjoy your retirement without worrying about money.

Remember to come back and re-evaluate your income and expenses regularly. If spending creeps up in one category, you might need to offset that in another. And keep planning ahead for those big one-time expenses that will inevitably crop up.

No, I have much Higher Expected Retirement Income than I Plan to Spend

This is a nice problem to have. If you haven’t yet retired, you might consider pulling the plug sooner rather than later. Or taking a partial retirement and easing into it, if you’re not sure what to do with all that free time.

Alternatively, you could plan to live a bit more lavishly. Take bigger vacations. Enjoy yourself.

Or maybe you want to gift some funds to children or grandchildren, so that you can enjoy watching them spend the money. This could be a straightforward cash gift, or a specific item like a family cruise or education fund.

Charities are another great alternative for extra funds. There are so many worthy causes, so find one that speaks to you.

Still nervous about running out of money? Don’t make any changes yet, and re-evaluate in a couple of years. If you still seem to have way more income than expenses, you can take that dream vacation at that time.

Sadly, my Retirement Expenses are Higher than my Income

While this isn’t the situation you were hoping for when you started out on this retirement budgeting exercise, better than you know now.

There are several different approaches to this problem, and you can mix and match the solutions that work best for you.

Earn more income. If you haven’t retired yet, keep working for an extra year or two. This has several benefits. You’re living off your income for those extra years instead of drawing down your savings. You can contribute more to your retirement fund to have a bigger nest egg. If you have medical benefits through work, you can continue to get discounts on dental expenses, new eye glasses, and more rather than paying out of pocket. If you delay starting government senior benefits, you may get more per month later on.

If you have already retired, consider picking up some income on the side: filling in for vacation days at your old job, consulting as an expert in your field, part-time work such as retail, or set your own schedule working for Uber (driving or delivery), Freelancer.com, Rover (dog walking), or others.

If you own your home, consider one of the suggestions at the top of this article for pulling funds out of that asset. Downsizing or moving to a cheaper cost-of-living city will give a big one-time injection of cash into your retirement nest egg, that you can then draw from a little each year.

Cut back on spending. Instead of planning for a big vacation every year, mix it up with holidays closer to home or visiting relatives. Order take-out instead of going to restaurants so you can save on the cost of drinks and tipping. Call the phone or cable company and negotiate for a better rate on a discount plan.

Want to Learn More?

Here are my favourite personal finance books on retirement from Amazon!

As the title suggests, “The Five Years Before you Retire” is really a pre-retirement book. Set yourself up for success before you hand in your notice.

Suze is one of America’s most recognized personal finance experts.

Todd provides clear rules to ensure your nest egg lasts as long as you do.

And Canada’s #1 bestselling retirement income book, by Frederick Vettese. (Canadians can still get a lot of value out of American authors. Simply generalize the discussions on 401(k) plans to RRSPs. The details are different, of course, but the principles are sound. And of course the budgeting and spending tips are universal.)

Final Thoughts

Many people end up working too long before retirement, or being far too frugal in retirement, due to the fear of running out of money. Having a good retirement budget can help alleviate this fear. Don’t miss out on time with your family, travelling to great destinations, supporting important charities and causes, pursuing a new hobby, or other ways of spending your time and money.