If you need to get on top of your mountain of debts, you’re not alone. The circumstances that brought you here may be not under your control. But you CAN start to chip away at that iceberg! Maybe you’ve heard of the debt snowball versus debt avalanche debate. Which one is the best way to pay off debt? Get rid of all the stress of owing money, and pay those loans off with one of these great debt elimination plans!

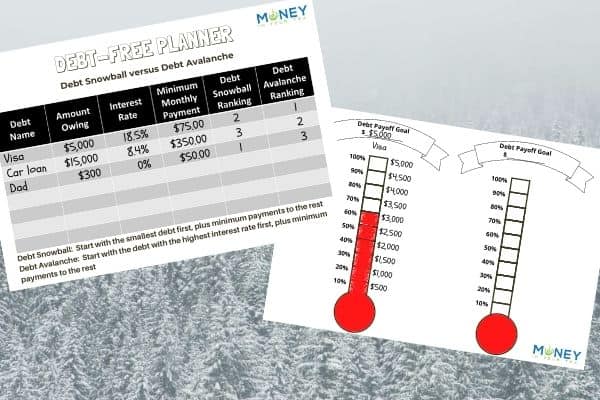

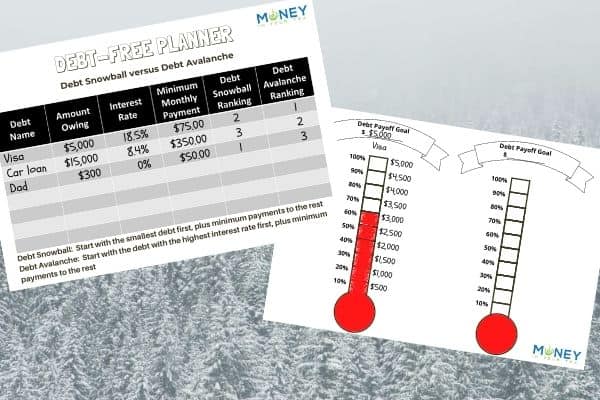

Download a FREE printable debt-free planner, and debt-free thermometer to track your progress! Keep reading, or skip to the end for the free snowball versus avalanche debt-free trackers!

“The unprecedented federal government income support programs and payment deferrals by financial institutions have been paramount for averting a delinquency tsunami and protecting household finances,” she said. “However, more challenging times are likely ahead.“

– Ksenia Bushmeneva, TD Bank, as reported by CBC

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

Why Should You Pay Down Debt?

Let’s start here. Why should you pay down debt, anyways? It’s not fun. It’s hard work. You probably have to sacrifice things you like (your latte? avocado toast?) and you don’t really want to.

Here are 8 benefits of tackling that debt mountain sooner, rather than later:

- Reduces stress and worry in your life.

- Eliminates calls from debt collectors, and the risk of your assets being repossessed.

- Improves your credit score. (Find out what is your credit score and why you should care!)

- Increases your net worth.

- Builds room in your budget to save and invest for your future, including retirement.

- Gives you a cushion if you face a future loss of income or large expense.

- Improves your relationship with your partner – no more arguments about money.

- Teaches your children good money habits.

“Canadian households were highly indebted before the COVID-19 pandemic changed our way of life.”

– CMHC

Step 1 in Paying Down Debt: Write Everything Down

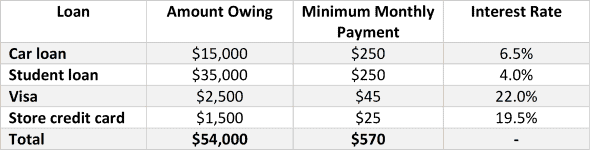

The first step in tackling any amount of debt, is to know how much you owe, and what it’s costing you in interest.

Make a list like this one, with every credit card, store card, bank loan, car loan, student loan, and so on. Be specific, if you have two similar loans, like two different Visa cards.

Look at your most recent statements. Either paper statements or online banking. Include in your list what is your outstanding balance, how much is your minimum payment, and what is the interest rate.

Here’s my example:

Where to start, when you owe so many different loans? Which debt should be paid off first?

What is the Debt Snowball Method?

The debt snowball method of paying off debt was popularized by the well-known personal finance expert, Dave Ramsey. (Want to know more? Pick up Dave Ramsey’s book at Amazon!)

First we’re going to reorder that list of debts, from the smallest amount owing to the largest:

- Store credit card: $1,500

- Visa: $2,500

- Car loan: $15,000

- Student loan: $35,000

Next, you’ll pay the minimum balance only on all the debts except the smallest one. Put all your extra funds towards that one.

Let’s say you have $800 per month to put towards your debts. That’s $250 to your student loan, $250 to your car loan, $45 to your Visa, and the remaining $255 to your store credit card.

Look at that! You’ll have that store credit card paid off in just over 6 months!

This is the key to the debt snowball method – getting those quick wins in, so that you see progress fast and increase your motivation to keep going.

Once the smallest debt is paid off, put the $255 that was going to the store credit card plus the $45 you were already paying to Visa, all into the Visa bill. That is, you’re now paying $250 for the car loan, $250 for the student loan, and $300 to Visa each month.

Repeat until all your debts are paid off.

You can see how your payments just snowball, as you pay off the small loans and add those funds to pay off the next.

What is the Debt Avalanche Method?

In the debt avalanche method, we’re going to reorganize the list of debts from the highest interest rate to the lowest:

- Visa: 22%

- Store credit card: 19.5%

- Car loan: 6.5%

- Student loan: 4%

Next, you’ll pay the minimum balance only on all the debts except the one with the highest interest rate. Put all your extra funds towards that one.

If you have $800 per month to put towards your loans, you would pay $250 to the student loan, $250 to the car loan, $25 to the store credit card, and the remaining $275 to the Visa.

Once the Visa is paid off, put all the extra funds towards the debt with the next highest interest rate – the store credit card.

It will take a little longer to see that first “win”. But mathematically the debt avalanche makes the most sense, because you will pay less in interest if you target your debts this way. In the end you’ll pay off your debts faster, too.

What is the Best Debt Payoff Method? Debt Snowball or Debt Avalanche?

The only difference between the debt avalanche and debt snowball is the order in which you choose the first debt to focus on. Is it better to pay off lowest balance or highest interest?

Some people have very fierce opinions about which method is better. Dave Ramsey is a strong advocate for the debt snowball. It builds motivation and a habit of paying down debts. Others believe the math is more important, and therefore favour the debt avalanche. In the end, it likely doesn’t make much difference – maybe a couple of months and a few hundred dollars over the course of 5 or more years.

The best choice is which method appeals most to you. Will you be more motivated to stay on track by the quick wins of the debt snowball? Or does the math win out, with the idea of spending as little as possible on interest and becoming debt-free as soon as possible, with the debt avalanche?

And maybe it goes without saying, but I’ll say it anyways. While you’re paying off your loans, don’t take on any more debt! Pay for everything with debit or e-transfers or cash, and only up to what you can afford. You really don’t want to be increasing a MasterCard bill while you’re paying down the Visa.

FREE Printables! Debt Snowball versus Debt Avalanche Planner and Debt-Free Thermometers

Now you’ve got a much clearer sense of whether the debt snowball or the debt avalanche is the best method for you. Do you need an early win with a small debt? Are you motivated by paying as little interest as possible? Do you need to prioritize paying off one of the debts first, regardless of snowball versus avalanche?

Let’s start putting this into practice. Download my debt-free planner right here. (If you don’t see where to enter your email address, try turning off your popup blocker.)

Next, look up all your outstanding debts. Write down the name, how much you owe, the interest rate, and the minimum monthly payment. Once they’re all written down, start ranking them.

For the debt snowball, label the smallest debt #1, the next smallest #2, and so on.

For the debt avalanche, label the one with the highest interest rate #1, the next highest interest rate #2, and so on.

Print off enough debt-free thermometers for all your debts, then start filling them out. As you make your payments, fill in the squares until you get to the top!

“Overall, consumers’ expectations around labour market conditions continued to be weaker than before the COVID‑19 outbreak. … [Y]ounger workers could face the risk of longer-lasting economic damage (e.g., loss of work experience) from being out of the labour force for longer.”

– Bank of Canada

Turn the Debt Snowball or Debt Avalanche into a Major Blizzard!

Regardless of your choice between debt avalanche versus debt snowball, increasing your monthly debt payments will make a far bigger difference to how fast you’ll pay off those loans. You could shave months or years off your debt repayment and save hundreds or even thousands of dollars in interest by repaying just an extra $50 per month!

A lot of people don’t know where to start with a budget or financial plan, and so they never start at all. If this describes you, you are not alone! So many people are intimidated by budgeting.

The Highlighter Budget

The highlighter budget is perfect for those who hate spreadsheets. It’s one of the easiest ways to track your expenses, which is an essential first step in any good financial plan. The highlighter budget is simply looking at how you have already spent your money. Then you get to decide if you want to continue spending it this way. Print out your latest bank statements and credit card statements, then highlight your income and spending by category.

The 50/30/20 Budget

The 50/30/20 budget rule is a simple and intuitive plan to help you reach your financial goals. Allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Feel free to cut back even further on your wants and needs in order to send more than 20% of your income to paying off your debt even faster!

Spend Less or Earn Extra Income

How can I pay off debt fast with no money? Look at all the ways you can cut back your spending on household bills and groceries. Then consider ways to earn extra income. Selling off some things you don’t use anymore can give you a few hundred extra dollars to put towards one of your debts. Or bring in a little extra each and every month with a side hustle like Freelancer or Fiverr. Put all the extra income towards your target debt to pay it down even faster.

Final Thoughts

The most important part of paying down your debts is changing behaviours. Find any extra money you can to put towards debt. Then choose between the debt snowball or debt avalanche method, whichever appeals to you and will keep you on track. Make those payments every month, and you’ll start seeing progress before you know it.

Great post, MIYT! Very timely with everything that has been happening. Debt can be devastating. Just looking at the numbers in your example turns my stomach lol. The largest amount of debt I have ever had is my student loan. When I started it was around $23,000. Now I only have about $1,500 left. Thanks for the extra motivation.