Have you been thinking about switching from high-fee mutual funds to low-fee ETFs in your RRSP or TFSA? Find the answers to all your questions. Then follow these exact steps to avoid government penalty fees.

Key Takeaways:

- Mutual funds and ETFs can both give good diversification, but mutual funds typically have much higher fees.

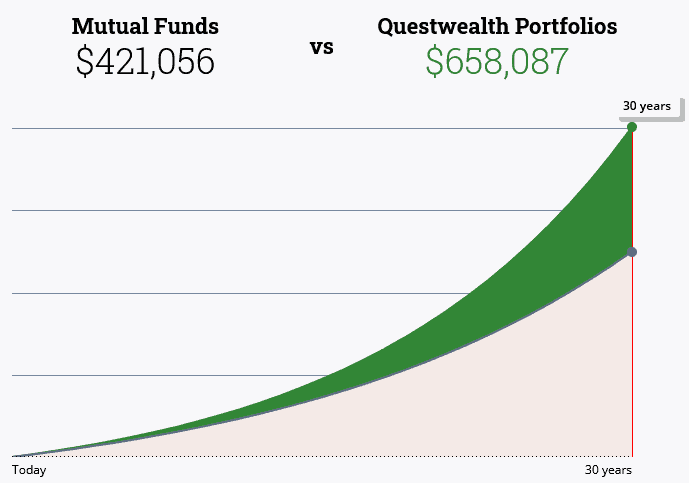

- Paying high mutual fund fees can significantly reduce how much money you’ll have at retirement.

- Can you buy ETFs in an RRSP or TFSA? Yes!

- Discover the difference between mutual funds, ETFs and index funds.

- Switch from mutual funds to ETFs within an RRSP or TFSA account the correct way to avoid government penalties.

This post may contain affiliate links, which means I make a small commission if you decide to purchase something through that link. This has no cost to you, and in some cases may give you a discount off the regular price. If you do make a purchase, thank you for supporting my blog! I only recommend products and services that I truly believe in, and all opinions expressed are my own. As an Amazon Associate I earn from qualifying purchases. Please read my disclaimers for more information.

A Brief Comparison of Mutual Funds and ETFs

If you already know the difference between mutual funds and ETFs – exchange traded funds – feel free to skip ahead to the next section. Otherwise, keep reading!

Mutual Funds – Well Diversified Investing, but Expensive

Mutual funds can be thought of as a “basket” of investments. Money pooled from thousands of people is used by the mutual fund manager to invest in a well-diversified range of companies. The diversification is great. But because these funds are actively managed, the fees can be quite high.

The management fees charged to you is called the MER – management expense ratio. A typical mutual fund charges a MER of about 2%. That means that for every $100,000 invested, they deduct $2,000 every year for their fees. If the fund goes up by 5%, they charge you 2%. If your account goes down by 10%, you still pay 2%! Do you feel you’re getting $2,000 worth of investment advice from your mutual funds?

In addition, mutual funds may also charge fees when you purchase or sell your mutual funds, which can be hundreds of dollars and up.

Mutual Fund Fees in Canada Are Among the World’s Highest

Source: Barron’s

Why Choose ETFs over Mutual Funds? – Well Diversified, but Much Cheaper

ETFs also can be thought of as a basket of investments – money pooled from thousands (or millions) of people, to invest in a wide range of companies.

The management expense ratio for ETFs is typically about 0.25%. That is, one-quarter-of-one-percent. For the same $100,000 investment, the annual fee is now $250. ETFs are not actively managed. They have a stated objective, such as tracking the Toronto Stock Exchange Index, and they stick with it. This makes the cost of investing in ETFs much lower. And do you know what? Studies have shown that as a whole, mutual fund managers are not particularly good at picking “winners”.

About 63% of actively managed mutual funds deliver inferior returns compared to the S&P 500 index in a given year. Over a five-year period, about 78% of fund managers underperform.

Source: The Motley Fool

The only other fees you face are when you purchase and sell ETFs, which range from about $10 per trade at the big bank investment companies, to $0 ETF purchases at Questrade.

ETFs can be bought and sold at any time during the business day, just like stocks. Mutual funds are only priced at the end of the day.

Some mutual funds require high minimum investments. You can invest even small amounts of money into an ETF.

Mutual Funds vs ETFs vs Index Funds

Index funds are investments that track major stock market indexes, such as the Toronto Stock Exchange, as close as possible. Index funds can be either ETFs or mutual funds.

There is very little effort required by the fund manager, as they simply follow the index rather than do detailed research on individual companies.

Mutual fund index funds typically still have higher expense fees than ETFs that track the same index.

If you’re just starting out with investing, find out which is right for you – RRSP vs TFSA.

Should you Convert Mutual Funds to ETFs?

This is a personal decision. But if mutual funds are no longer meeting your needs, if you feel you are not receiving good investment advice for the amount you pay in MER fees, the time may be right for switching. Mutual fund expenses can significantly reduce your investment returns.

If you have a significant amount invested in your registered retirement fund or tax-free savings account, the savings in management fees can be substantial. Moreover, that savings stays invested and keeps growing year after year.

On the other hand, if you have under $1,000 invested, the annual savings from converting to ETFs may not even be enough to buy a pizza.

If you are switching within an RRSP or TFSA and do it properly, there are no government tax consequences.

However, if you are converting mutual funds to ETFs in a non-registered account, you will incur capital gains on the mutual funds as you sell them. These will be taxable as income for the year. Consider seeking out independent advice about managing this process.

Where can you buy ETFs?

Your mutual fund investments may be with one of Canada’s big banks, or with an investment company. Often you’ll need to switch to a new investment firm.

The big banks all have investment companies. Bank of Montreal has BMO Investorline. TD Bank has TD Direct Investing.

Questrade is Canada’s fastest growing, low-cost favourite. While it may or may not have the same name recognition as the banks, Questrade has been in Canada for over 21 years. They have over $25 billion – with a B – assets under administration. And they offer a choice of DIY investing or an advisor to assist you. The choice is yours. Either way, the fees are substantially less than with mutual funds, and add up to real savings over the long run.

How to Avoid Government Penalty Fees and Taxes when you Convert to ETFs in your RRSP or TFSA

This step is the most important to get right. You should NOT sell all your mutual funds in your RRSP or TFSA and withdraw it from these accounts. Withdrawing from an RRSP to move money to an ETF will result in having to pay tax on the full amount as income. Withdrawing from a TFSA means that contribution room will not be available to you until next January 1st.

You want to “transfer” not “withdraw” to move your money from mutual funds to ETFs.

If you invest in mutual funds in an RRSP, you will need to open an RRSP investment account. If your mutual funds are in a TFSA account, then your new account must be a TFSA.

You should be open with your current bank or investment company about your plans, and ask them to transfer from your current registered account to the new registered account. This ensures that the tax advantaged status of your current RRSP or TFSA is not removed.

The same process applies when converting from mutual funds to ETFs within your child’s RESP education fund.

What does it Mean to Transfer In-Kind or in Cash?

You can ask for your mutual funds to be transferred “in-kind”. That means that when the transfer is complete, your new account will have the same mutual funds as you currently hold. You would then need to sell them and purchase your ETFs.

Alternatively, you can sell your mutual funds within your RRSP or TFSA and have them transfer cash to your new account. Then you’re ready to invest in ETFs right away.

There is no right or wrong choice here. Either way, the process can take at least 2 weeks. More, in my experience, if you’re doing this over the holidays. Doing an in-kind transfer can reduce the risk of missing market gains while your funds are in cash. But it may result in a fee to sell the mutual funds later, and a slightly longer process before you buy those ETFs. It’s unlikely to make a big difference in the ultimate value of your RRSP or TFSA in the long run.

Once you have sold your mutual funds and have cash in your new investment account, decide whether you want to purchase your ETFs in a lump sum or by dollar cost averaging.

What ETFs Should you Invest in?

There are a wide range of ETFs out there. Many track large stock indexes, such as the Toronto Stock Exchange or the U.S. S&P. Others are more of a basket of indexes from European or Asian stock markets.

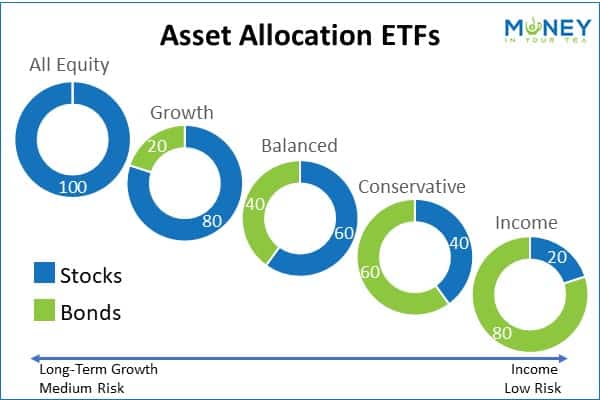

Many investors who are new to ETFs like to start with asset allocation ETFs. With asset allocation ETFs, you only need to decide your personal appetite for risk versus return. If you are investing for the long run, and you don’t mind weathering a few stock market ups and downs, choose one with high equity (stocks). If you’re more conservative at heart, choose one with more bonds.

A balanced asset allocation ETF is 60% stocks and 40% bonds. Examples include XBAL from iShares, VBAL from Vanguard, and ZBAL from BMO. You would purchase just this one ETF, and within that you would be invested in stocks and bonds from Canada, the U.S., emerging markets and other international stock markets, as well as bonds from Canada and the U.S. (as of 2021).

You can invest in asset allocation ETFs as well as other types of ETFs within your registered retirement account or TFSA.

If you are more experienced, you may want to look into cryptocurrency or dividend investing.

I am not a registered investment advisor, and personal finance is just that – personal. Please make the best investment decisions that are right for your situation.